Build-to-Rent

Key Takeaways

BTR

Build-to-Rent ("BTR") refers to a stand-alone residential property that is designed to house one family, as opposed to a multi-family dwelling like an apartment building. BTR homes are generally rented by individuals and households in their late 30’s and 40’s across all income brackets.

Building type

BTR can come in various building types with their own characteristics. The suitability of a particular building type for BTR depends on various factors, including the local housing market, tenant preferences, and investor goals.

Primary Drivers

The primary drivers influencing the BTR sector encompass a limited supply of attainable homeownership options, escalating interest rates, and elevated home prices. This situation impedes millennials, anticipated to be the primary BTR renters, from affording a home, thereby boosting demand for rental properties in the sector.

What is Build-to-Rent?

BTR is comprised of attached or detached one-unit homes typically in suburban neighborhoods with amenities such as private yards and off-street parking. BTR is part of the broader single-family rentals (“SFR”) market, which represents the second largest category of rental housing in the US, with 14 million units nationwide, and 31% of all occupied rental units.i

BTR represents a distinct and growing segment within SFR. Unlike traditional SFR properties—which are typically fragmented and owned by small-scale “mom-and-pop” investors—BTR communities are generally institutionally owned and purpose-built for rental. These neighborhoods usually feature 50 or more single-family homes or townhomes, often include shared amenities, and are professionally managed to ensure consistent leasing, maintenance, and resident services.ii

Who lives in single-family real estate?

Renters’ propensity to live in single-family rental homes is highest during their late 30’s and 40’s when household sizes tend to be largest due to children living at home. These residents are often drawn to BTR for its larger floor plans, greater privacy, and quieter neighborhoods. However, BTR also appeals to empty nesters, who are drawn to the financial flexibility and low-maintenance lifestyle that renting provides,iii as indicated by the 72% percent of older singles and couples in BTR communities who are former homeowners.iv

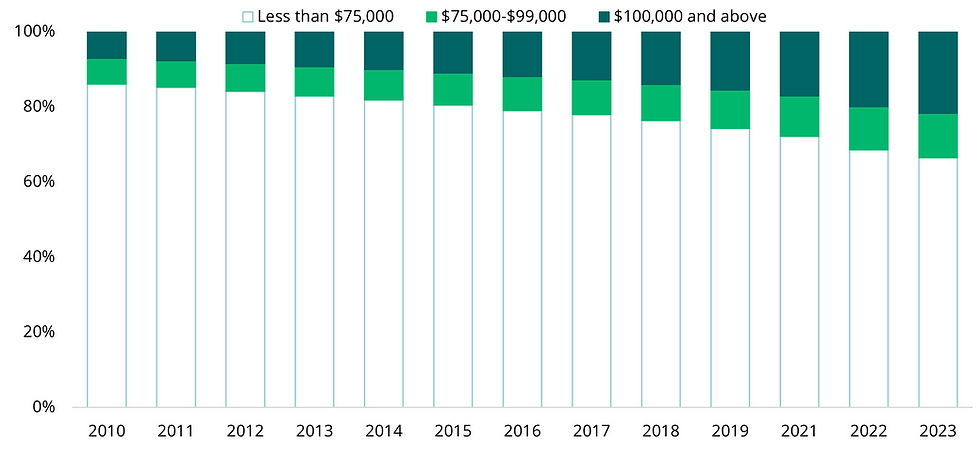

Furthermore, the share of high-income renters in the US is on the rise as more people choose to rent amid an ongoing shift in lifestyle preferences. One third of renter households earn more than the US median of ~$75,000 per year.v

Share of High-Income Renters vi

.png)

What are the secular drivers of this sector?

Millennials: BTR saw fundamentals steadily strengthen during the last economic cycle and then accelerate during the pandemic as consumers prioritized larger living spaces following an increase in remote work. Furthermore, as millennials approach middle age, the age cohort of 35 to 49 year-olds is projected to register elevated growth over the next few years,vii which is supportive of BTR demand.

Prime BTR Target Demographic Anticipated to Grow viii

.png)

Limited Supply: In addition to subdued single-family construction for over a decade, single-family construction activity in the US has increasingly targeted higher price points, limiting the availability of new entry-level housing and keeping households in rental units longer.ix

Barriers to homeownership: Elevated home prices, which have jumped a little over 50% since late 2019x, coupled with elevated interest rates has made purchasing a home more difficult, making BTR a relatively more affordable option.

Starter Home Production Has Fallen Significantly xi

Monthly Cost of Owning vs Renting xii

What are the common BTR building types? xiii

Single-Level Rowhome Communities

These communities tend to attract older renters, making accessibility a higher priority, while outdoor yard space is less of a concern. Tenants often value generous storage space to accommodate long-held belongings. The appeal lies in the single-family feel paired with the convenience of on-site maintenance and professional management.

Townhome Communities

The multi-story design appeals to renters seeking more space and privacy than a typical apartment can offer. These homes often include garages and offer a greater sense of separation—at a more accessible price point than detached homes.

Single-Family Detached Communities

Tenants prioritize larger layouts, highlighting bedroom count and square footage as key features. Elements like laundry rooms and walk-in storage help these homes feel more like a permanent residence than an apartment. The main attraction is spaciousness—especially multiple bedrooms and welcoming communal areas like kitchens.

Horizontal Apartment (Cottage) Communities

A private, often fenced backyard is a major factor influencing rental decisions, especially for pet owners and those who value outdoor space. Though the units are typically smaller, open layouts and high ceilings help them feel more expansive. Renters are drawn to the detached-home feel without shared walls or upstairs/downstairs neighbors.

Top Tier

Mid Tier

Bottom Tier

SFR renters are found across all income brackets, calling for various market clearing rent levels to cater to a diverse range of needs. SFR homes can be categorized into three major tiers of quality based on the below general characteristics.

How is value identified and created at the asset level?

Passive Management

Data analysis can provide investors with the tools to identify sought-after locations (e.g., high ranking schools, safe neighborhoods, etc.), which often correlates to strong capital appreciation over time.

Active Management

Institutional BTR owners can efficiently plan and implement property updates at scale, creating efficiencies for procurement and renovation execution typically not available to smaller owners. Institutional players also often professionalize property management services, which can align interests at the asset level and improve leasing activities through broad digital marketing efforts.

What Are the Different BTR Models xiv

Vertically Integrated Model:

A single organization oversees the entire process—from land acquisition and construction to leasing and property management—allowing for full control over design, quality, and operations. This model requires significant capital investment and deep expertise across multiple disciplines.

Contractor Model:

The investor purchases and finances the land and project, while a builder is contracted to construct the homes based on provided plans and specifications. The builder acts purely as a contractor and is not involved in ownership or operations.

Partnership Model:

A builder typically acquires the land and partners with an investor who agrees in advance to purchase completed homes, often providing a deposit to help offset construction and financing costs. The investor may influence design elements and specifications but does not manage the construction directly.

Explore private equity Sectors

Explore Private Real Estate Asset Classes

Explore select private market asset classes to understand better what they are, who uses them, and the potential to identify value.

© 2025 Bridge Investment Group Holdings LLC. “Bridge Investment Group” and certain logos contained herein are trademarks

owned by Bridge.

The information contained herein is for informational purposes only and is not intended to be relied upon as a forecast, research, investment advice or an investment recommendation. Reliance upon the information in this material is at the sole discretion of the reader. Past performance is not necessarily indicative of future performance or results.

This material has been prepared by the Research Department at Bridge Investment Group Holdings LLC (together with its affiliates, “Bridge”), which is responsible for providing market research and analytics internally to Bridge’s strategies. The Research Department does not issue any independent research, investment advice or investment recommendations to the general public. This material may have been discussed with or reviewed by persons outside of the Research Department.

This material does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This material discusses broad market, industry, or sector trends, or other general economic, market, social, legislative, or political conditions and has not been provided in a fiduciary capacity under ERISA.

Economic and market forecasts or estimated returns presented in this material reflect the Research Department’s judgement as of the date of this material and are subject to change without notice. Although certain information has been obtained from third-party sources and is believed to be reliable, Bridge does not guarantee its accuracy, completeness, or fairness. Bridge has relied upon and assumed without independent verification, the accuracy and completeness of all information available from third-party sources. Some of this information may not be freely available and may require a subscription or a payment. Any forecasts or return expectations are as of the date of material and are estimated and are based on market assumptions. These assumptions are subject to significant revision and may change materially as economic and market conditions change. Bridge has no obligation to provide updates or changes to these forecasts.

This material includes forward-looking statements that involve risk and uncertainty. Readers are cautioned not to place undue reliance on such forward-looking statements. Any reference to indices, benchmarks, or other measure of relative market performance over a specified period of time are provided for context and for your information only.