Build-to-Rent

Key Takeaways

BTR

Building type

Primary Drivers

What is Build-to-Rent?

BTR is comprised of attached or detached one-unit homes typically in suburban neighborhoods with amenities such as private yards and off-street parking. BTR is part of the broader single-family rentals (“SFR”) market, which represents the second largest category of rental housing in the US, with 14 million units nationwide, and 31% of all occupied rental units.i

Build-to-Rent represents a distinct and growing segment within SFR. Unlike traditional SFR properties—which are typically fragmented and owned by small-scale “mom-and-pop” investors—BTR communities are generally institutionally owned and purpose-built for rental. These neighborhoods usually feature 50 or more single-family homes or townhomes, often include shared amenities, and are professionally managed to ensure consistent leasing, maintenance, and resident services.ii

Who lives in single-family real estate?

Renters’ propensity to live in single-family rental homes is highest during their late 30’s and 40’s when household sizes tend to be largest due to children living at home. BTR These residents are often drawn to BTR for its larger floor plans, greater privacy, and quieter neighborhoods. However, BTR also appeals to empty nesters, who are drawn to the financial flexibility and low-maintenance lifestyle that renting provides,iii as indicated by the 72% percent of older singles and couples in BTR communities that are former homeowners.iv

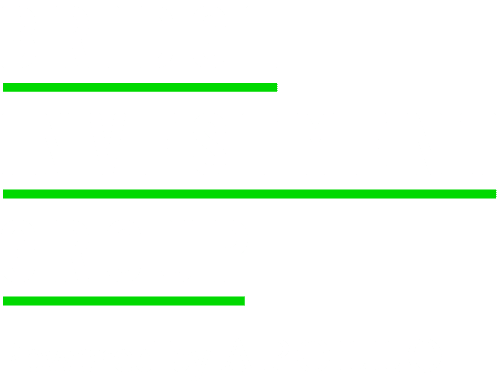

Furthermore, the share of high-income renters in the US is on the rise as more people choose to rent amid an ongoing shift in lifestyle preferences. One third of renter households earn more than the US median of ~$75,000 per year.v

Share of High-Income Renters vi

What are the secular drivers of this sector?

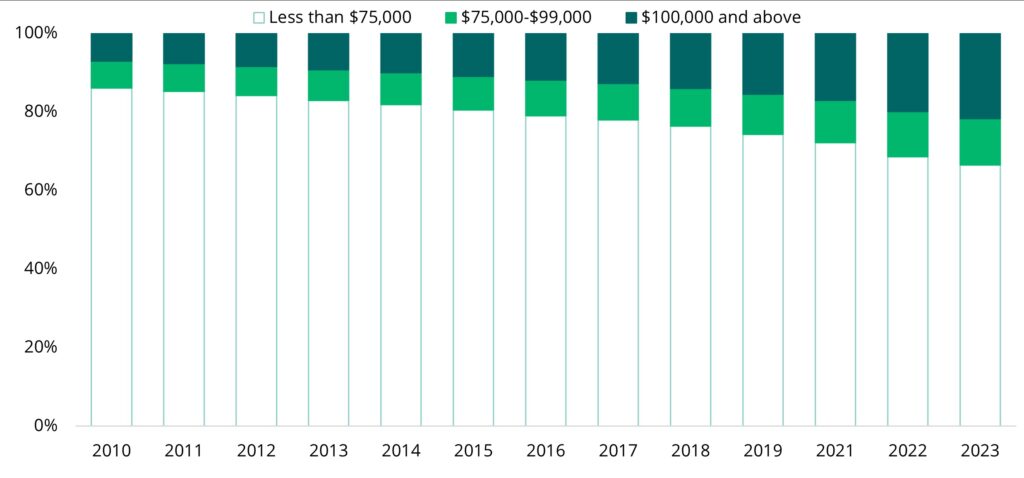

Millennials: BTR saw fundamentals steadily strengthen during the last economic cycle and then accelerate during the pandemic as consumers prioritized larger living spaces following an increase in remote work. Furthermore, as millennials approach middle age, the age cohort of 35 to 49 year-olds is projected to register elevated growth over the next few years,vii which is supportive of BTR demand.

Prime BTR Target Demographic Anticipated to Growviii

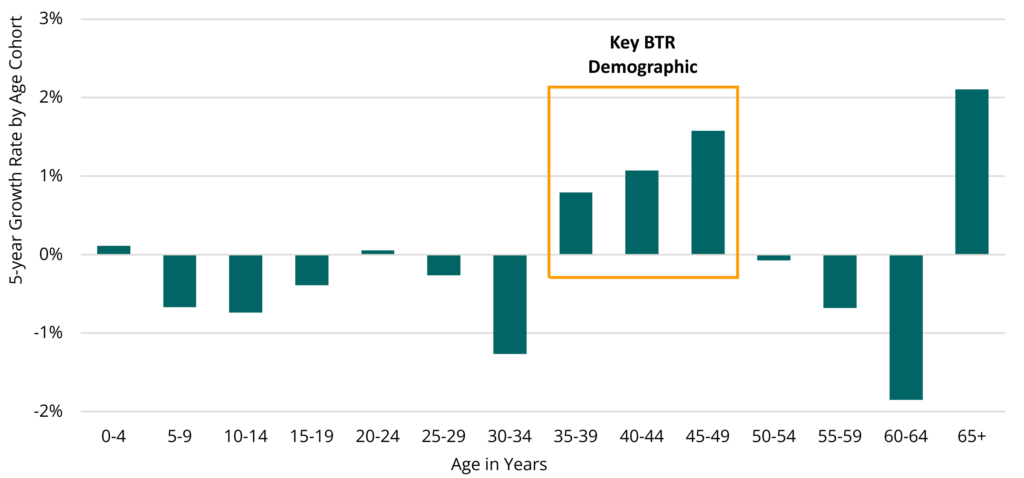

Limited Supply: In addition to subdued single-family construction for over a decade, single-family construction activity in the US has increasingly targeted higher price points, limiting the availability of new entry-level housing and keeping households in rental units longer.ix

Barriers to homeownership: Elevated home prices, which have jumped a little over 50% since late 2019x, coupled with elevated interest rates has made purchasing a home more difficult, making BTR a relatively more affordable option.

Starter Home Production Has Fallen Significantlyxi

Monthly Cost of Owning vs Rentingxii

WHAT ARE THE COMMON BTR BUILDING TYPES?xiii

Single-Level Rowhome Communities

These communities tend to attract older renters, making accessibility a higher priority, while outdoor yard space is less of a concern. Tenants often value generous storage space to accommodate long-held belongings. The appeal lies in the single-family feel paired with the convenience of on-site maintenance and professional management.

Townhome Communities

The multi-story design appeals to renters seeking more space and privacy than a typical apartment can offer. These homes often include garages and offer a greater sense of separation—at a more accessible price point than detached homes.

Single-Family Detached Communities

Tenants prioritize larger layouts, highlighting bedroom count and square footage as key features. Elements like laundry rooms and walk-in storage help these homes feel more like a permanent residence than an apartment. The main attraction is spaciousness—especially multiple bedrooms and welcoming communal areas like kitchens.

Horizontal Apartment (Cottage) Communities

A private, often fenced backyard is a major factor influencing rental decisions, especially for pet owners and those who value outdoor space. Though the units are typically smaller, open layouts and high ceilings help them feel more expansive. Renters are drawn to the detached-home feel without shared walls or upstairs/downstairs neighbors.

Top Tier

Mid Tier

Bottom Tier

SFR renters are found across all income brackets, calling for various market clearing rent levels to cater to a diverse range of needs. SFR homes can be categorized into three major tiers of quality based on the below general characteristics.

|

Top Tier |

Mid Tier |

Bottom Tier |

|

|---|---|---|---|

|

Type of Home |

Detached single-family homes or newly constructed attached homes. |

Detached single-family homes on traditional lots. |

Cottages or small single-family detached or attached homes. |

|

Typical Year Built |

2010’s or newer |

1990’s or 2000’s |

1980’s or earlier |

|

Typical Home Size |

2,000 – 2,800 SF |

1,400 – 2,000 SF |

650 – 1,500 SF |

|

Bedrooms |

3 – 4 Bedrooms |

2 – 4 Bedrooms |

1 – 3 Bedrooms |

|

Community Amenities |

Pools, gated entrances, walking trails, and yard maintenance are common. |

Pocket parks or dog parks and yard maintenance common. |

Not typical. |

|

Neighborhood |

Easy access to white-collar jobs, dining, and shopping with well-regarded schools. |

Moderately easy access to jobs, dining, and other city amenities; school quality can vary. |

Schools are likely to be less highly rated. |

How is value identified and created at the asset level?

Passive Management

Data analysis can provide investors with the tools to identify sought-after locations (e.g., high ranking schools, safe neighborhoods, etc.), which often correlates to strong capital appreciation over time.

Active Management

Institutional BTR owners can efficiently plan and implement property updates at scale, creating efficiencies for procurement and renovation execution typically not available to smaller owners. Institutional players also often professionalize property management services, which can align interests at the asset level and improve leasing activities through broad digital marketing efforts.

What Are the Different BTR Modelsxiv

Vertically Integrated Model:

A single organization oversees the entire process—from land acquisition and construction to leasing and property management—allowing for full control over design, quality, and operations. This model requires significant capital investment and deep expertise across multiple disciplines.

Contractor Model:

The investor purchases and finances the land and project, while a builder is contracted to construct the homes based on provided plans and specifications. The builder acts purely as a contractor and is not involved in ownership or operations.

Partnership Model:

A builder typically acquires the land and partners with an investor who agrees in advance to purchase completed homes, often providing a deposit to help offset construction and financing costs. The investor may influence design elements and specifications but does not manage the construction directly.

Explore Private Markets Further

Explore select private market asset classes to understand better what they are, who uses them, and the potential to identify value.

Explore Private Real Estate Asset Classes

Explore select private market asset classes to understand better what they are, who uses them, and the potential to identify value.

The information herein is provided for educational purposes only and should not be construed as financial or investment advice, nor should any information in this document be relied on when making an investment decision. Opinions and views expressed reflect the current opinions and views of the author(s) and Bridge Analysts as of the date hereof and are subject to change at any time without notice. Please see the end of this document for important disclosure information.

Important Disclosure Information

This material is for educational purposes only and should not be treated as research. This material may not be distributed, transmitted or otherwise communicated to others, in whole or in part, without the express written consent of Bridge Investment Group Holdings LLC (together with its affiliates, “Bridge”).

The views and opinions expressed in this material are the views and opinions of the author(s) of the material. They do not necessarily reflect the views and opinions of Bridge and are subject to change at any time without notice. Further, Bridge and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views expressed in this material. There can be no assurance that an investment strategy will be successful. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially and should not be relied upon as such. Target allocations contained herein are subject to change. There is no assurance that the target allocations will be achieved, and actual allocations may be significantly different than that shown here.

This material does not constitute an offer of any service or product of Bridge. It is not an invitation by or on behalf of Bridge to any person to buy or sell any security or to adopt any investment strategy, and shall not form the basis of, nor may it accompany nor form part of, any right or contract to buy or sell any security or to adopt any investment strategy. Nothing herein should be taken as investment advice or a recommendation to enter into any transaction.

Hyperlinks to third-party websites in this material are provided for reader convenience only. Unless otherwise noted, information included herein is presented as of the dates indicated. This material is not complete, and the information contained herein may change at any time without notice. Bridge does not have any responsibility to update the material to account for such changes. Bridge has not made any representation or warranty, expressed or implied, with respect to fairness, correctness, accuracy, reasonableness, or completeness of any of the information contained herein, and expressly disclaims any responsibility or liability, therefore. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Investors should make an independent investigation of the information contained herein, including consulting their tax, legal, accounting or other advisors about such information. Bridge does not act for you and is not responsible for providing you with the protections afforded to its clients.

Certain information contained herein may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such information. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Any reference to indices, benchmarks, or other measure of relative market performance over a specified period of time are provided for context and for your information only.

Past performance is not necessarily indicative of future results.

Additional information may be available upon request.

© 2025 Bridge Investment Group Holdings LLC. “Bridge Investment Group” and certain logos contained herein are trademarks owned by Bridge.

- Capital Expenditures: Investments made to acquire, improve, and maintain an asset.

- Build-To-Rent (BTR): Construction of single-family units with the purpose of leasing upon completion. Can be both Certificate of Occupancy (CO) and Lot and Fee and Build.

- Dedicated Rental Communities (DRCs): Portfolios consisting of multiple homes that are purchased, likely from other operators, institutional investors, or public REITs.

- One-by-one home purchases: Single, separate acquisition of units aimed for leasing.

i U.S. Census Bureau, 2023 American Community Survey 1-Year Estimates, Table B25032.

ii CBRE, Build-to-Rent Residential Market Overview, October 16, 2024.

iii CBRE, Build-to-Rent Residential Market Overview, October 16, 2024.

iv Fannie Mae, Multifamily Economic and Market Commentary, Build-to-Rent Overview, October 2024.

vi U.S. Census Bureau, 2023 American Community Survey 1-Year Estimates; income adjusted for inflation, Table B25118.

vii U.S. Census Bureau, 2023 American Community Survey 1-Year Estimates; income adjusted for inflation, Table B25118.

viii Moody’s Analytics, Baseline Scenarios, as of April 2025.

ix U.S. Census Bureau, 2022 American Community Survey 1-Year Estimates.

x U.S. Census Bureau, Survey of New Construction: New Residential Sales, 2023.

xi U.S. Census Bureau, Survey of New Construction: New Residential Sales, 2023 and National Association of Realtors, Sales Price of Existing Single-Family Homes, December Median Price Figures, as of January 2023.

xii Moody’s Analytics, Baseline Scenario, as of April 2025. Mortgage calculations assume a 5% down payment, 30-year mortgage, average mortgage rate, and a home price at 80% of the national median.

xiii John Burns Research & Consulting, Get Product-Type Clarity to Home BTR Rents, March 15, 2024.

xiv Urban Institute, What Is the Build-to-Rent Sector, and Who Does It Serve? June 2023.

ON THIS PAGE…