Private Equity & secondaries

Key Takeaways

Private Equity

Private Equity (“PE”) Funds invest directly in private firms, often with a controlling interest.

investments

PE investments target a diverse field of companies at different stages of growth, allowing for timely investments potentially unavailable in public markets.

opportunities

PE often seeks opportunities to drive firms’ growth, improving operational efficiency and helping to shape directional focus.

Private equity Investment Strategies

PE consists of direct investments in privately held companies that operate in an range of economic sectors and geographies. These companies could include younger growth firms as well as mature enterprises that are looking to expand into new product lines or in need of strategic restructuring.

Conventional PE Funds typically grow these businesses through active, hands-on management and could utilize different strategies:

Growth Capital

Provides funding to mature companies seeking to expand or restructure without changing control.

Distressed Investments

Target companies facing financial challenges and aim either to improve financial stability or identify and separate economically viable business units.

Fund of Funds

Invest in other PE Funds rather than directly in companies, diversifying exposure.

Private Equity as an Asset Class

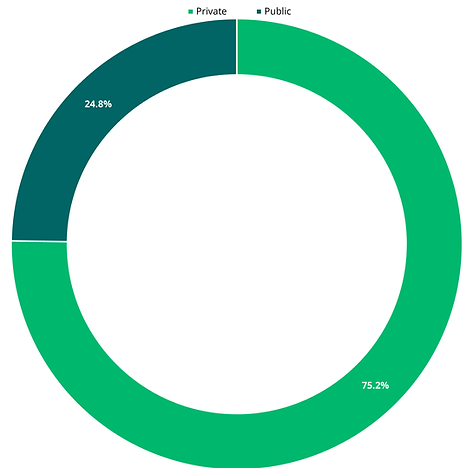

PE Funds offer exposure to a range of opportunities not accessible in public markets. In the US, three-quarters of companies that generate more than $250 million in annual revenue are privately held. However, the public equities market has become increasingly concentrated in recent years as the ten largest companies account for nearly 35% of the total market cap, almost twice the historical range of 18% to 23%.i

Nearly 75% of US Firms with $250+ million in Revenue are Private ii

The Seven Largest Firms Account for an Increasing Share Total Market Cap iii

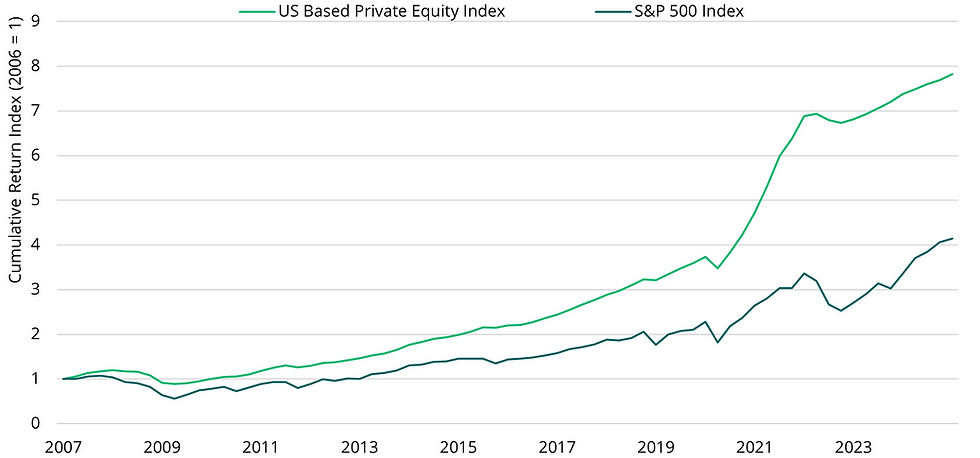

Over the long term, PE strategies have demonstrated outperformance and have delivered an annual net rate of return of 12.1% since 2007, more than 388 bps higher than the returns generated in public equities markets due to earnings growth as well as asset appreciation. iv

Private Equities Have Outperformed Public Equities in Cumulative Returns v

.png)

What Drives Value?

PE Funds conduct extensive due diligence on the financial performance and market positioning of target firms to identify attractive opportunities with untapped upside. Once the asset is acquired, the Funds have several potential levers to create value:

-

Operational improvements: PE firms often introduce new efficiencies and improve management practices to reduce costs or drive growth.

-

Technology and innovation: Provide capital to invest in new technologies that create a competitive edge or open up new revenue streams.

-

Strategic direction: Firms can offer expertise on optimizing capital structures, entering new sectors, or repositioning a business in a competitive market.

Secondaries

Key Takeaways

Secondaries

Private Equity Secondaries involve buying interests from the primary investors who committed directly to a PE Fund, providing flexibility and liquidity to private equity markets.

Growth

The Secondaries investment universe is rapidly growing in both breadth and depth.

opportunities

Secondaries often involve investment opportunities offered at a discount with shorter hold periods and quicker positive cash flows.

What Are Private equity Secondaries Funds?

Secondaries involve buying existing PE interests from the primary investors who committed directly to a PE fund during its original rounds of capital commitments. PE Secondaries is analogous in many ways to most public stock transactions, where sellers are usually shareholders, rather than the underlying companies tied to the stock under consideration.

Most Secondary purchases generally occur in one of two different transaction types, LP-led transactions and GP-led transactions.

-

An LP-led transaction involves transferring ownership of the LP's stake in a PE Fund to a buyer in the Secondary market.

-

A GP-led transaction is initiated and driven by the General Partner of a PE Fund who takes an active role in selling or restructuring the Fund's assets, potentially providing liquidity to Limited Partners, optimizing the Fund's portfolio, extending the Fund's life, or addressing changes in GP ownership or management.

What are the Secular Drivers for Secondaries?

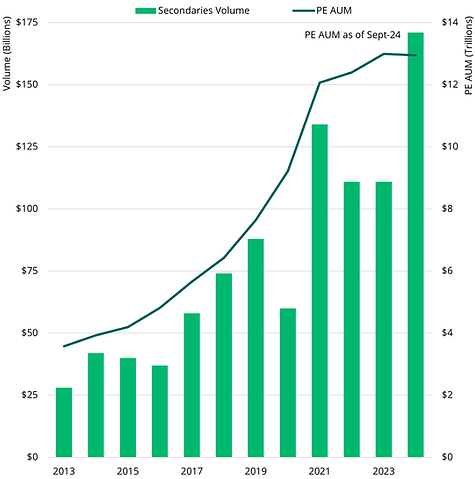

Secondaries is a rapidly growing class of PE investment that has seen annual market volume register a four-fold increase over the past decade to an annual total of $171 billion in 2024.vi Three drivers have been crucial in fueling the sector’s expansion:

-

Growth in primary PE: Growth in the conventional PE market and primary commitments creates more potential supply into the Secondaries market. Over the past decade, Secondaries volume has grown at nearly a 15% compound annual growth rate while PE assets under management (“AUM”) have grown 13% annually.vii

-

Portfolio rebalancing: As the value of public equity and fixed income portfolios declined starting in H2 2022, PE valuations remained generally flatter in comparison. This created the so-called ‘denominator effect’ in portfolios. As the relative weight of PE interests inside investment portfolios grows, Secondaries Funds have provided many investors with an ability to rebalance their portfolios. Rebounding public markets in 2023 provided some relief to the denominator effect, though volatile market activity could spur selloffs.

-

Lack of PE exits creating need for more liquidity: Uncertainty in macroeconomic conditions, tighter credit markets, and rising interest rates have limited the availability and attractiveness of debt, creating challenges and barriers for conventional PE exits. Secondaries Funds have in turn been more cautious and selective in their underwriting.

Secondaries Volume and Private Equity AUM viii

U.S. Private Equity Deal Exits ix

Secondaries as an Asset Class

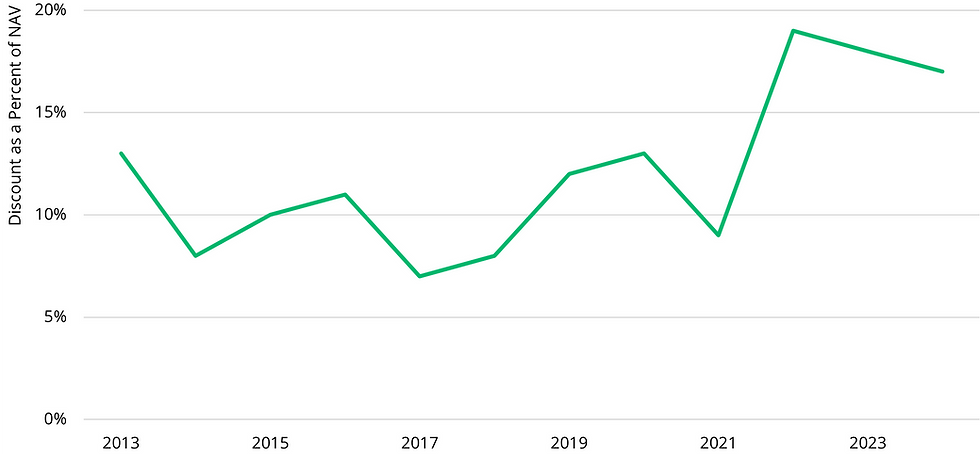

Buying at a Discount: Secondaries buyers typically acquire assets at a discount to net asset value (“NAV”) due to the seller’s need to generate liquidity or evolving investment goals. In the last three years, median Secondary purchase discounts have reached about 18% of NAV, creating immediate intrinsic value for buyers.x

Pre-Specified Pools: Secondary investors often buy interests after the PE Fund has been investing for several years, which means that many of the underlying assets have already been identified, limiting ‘blind pool’ risk. This allows for more in-depth due diligence and potentially greater confidence in expected cash flows.

Shorter Hold Periods: Secondary exposure to more mature funds also opens the door to potentially quicker positive cash flows as many of the PE funds have already worked through initial deal sourcing and are closer to the ‘harvest’ phase. This helps mitigate the J-curve effect that is typical for PE Funds and can lead to fewer capital calls.

Median Secondaries Acquisition Discount (as a Percent of NAV) xi

%20-%20Large%20(PDF).png)

Explore private equity Sectors

Explore Private Real Estate Asset Classes

Explore select private market asset classes to understand better what they are, who uses them, and the potential to identify value.

© 2025 Bridge Investment Group Holdings LLC. “Bridge Investment Group” and certain logos contained herein are trademarks

owned by Bridge.

The information contained herein is for informational purposes only and is not intended to be relied upon as a forecast, research, investment advice or an investment recommendation. Reliance upon the information in this material is at the sole discretion of the reader. Past performance is not necessarily indicative of future performance or results.

This material has been prepared by the Research Department at Bridge Investment Group Holdings LLC (together with its affiliates, “Bridge”), which is responsible for providing market research and analytics internally to Bridge’s strategies. The Research Department does not issue any independent research, investment advice or investment recommendations to the general public. This material may have been discussed with or reviewed by persons outside of the Research Department.

This material does not constitute an offer to sell any securities or the solicitation of an offer to purchase any securities. This material discusses broad market, industry, or sector trends, or other general economic, market, social, legislative, or political conditions and has not been provided in a fiduciary capacity under ERISA.

Economic and market forecasts or estimated returns presented in this material reflect the Research Department’s judgement as of the date of this material and are subject to change without notice. Although certain information has been obtained from third-party sources and is believed to be reliable, Bridge does not guarantee its accuracy, completeness, or fairness. Bridge has relied upon and assumed without independent verification, the accuracy and completeness of all information available from third-party sources. Some of this information may not be freely available and may require a subscription or a payment. Any forecasts or return expectations are as of the date of material and are estimated and are based on market assumptions. These assumptions are subject to significant revision and may change materially as economic and market conditions change. Bridge has no obligation to provide updates or changes to these forecasts.

This material includes forward-looking statements that involve risk and uncertainty. Readers are cautioned not to place undue reliance on such forward-looking statements. Any reference to indices, benchmarks, or other measure of relative market performance over a specified period of time are provided for context and for your information only.