Private Debt

Key Takeaways

Private Debt

Capital stack

Main Drivers

What is Private Debt?

Composition of Owners of US Commercial and Multifamily Mortgages as of Q3 2024ii

Key terms used in the sector

Loan Amount and Terms

Loan Proceeds are determined based on factors such as the property’s value, the borrower’s creditworthiness, and the property’s financial statements. Loan terms include the principal amount, interest rate, repayment period, and any other specific conditions agreed upon between the borrower and lender.

Interest Rates

Commercial real estate loans may have fixed or variable interest rates. Fixed-rate loans maintain a constant interest rate throughout the loan term, providing predictable payments. Variable-rate loans have interest rates that are tied to a reference rate, such as Prime Rate or Secured Overnight Financing Rate (“SOFR”) which adjust periodically based on market conditions.

Loan-to-Value (“LTV”) Ratio

LTV compares the loan amount to the appraised value of the property at origination. A lower LTV ratio indicates a lower risk for the lender. Commercial real estate LTVs typically range from less than a third to two-thirds of the capital stack. LTVs do not assume the value of planned capital improvements.

Loan Covenants

Lenders may include loan covenants, which are conditions or restrictions that borrowers must adhere to during the loan term. These may relate to financial performance, property management, or other factors. Covenants are not uniform and vary by lender, property, and identified risk factors.

Who are the borrowers of private debt?

Real estate owners and developers are the primary borrowers of private real estate debt to secure financing for property development or operational needs. The use of loan proceeds can range from property acquisitions, construction activities, or in some cases capital improvements. Loans can take on different forms, and one may invest in direct and/or conduit structures. Unlike conventional lenders, private debt can be tailored to specific project requirements without conforming to external regulations.

What are the secular drivers for the sector?

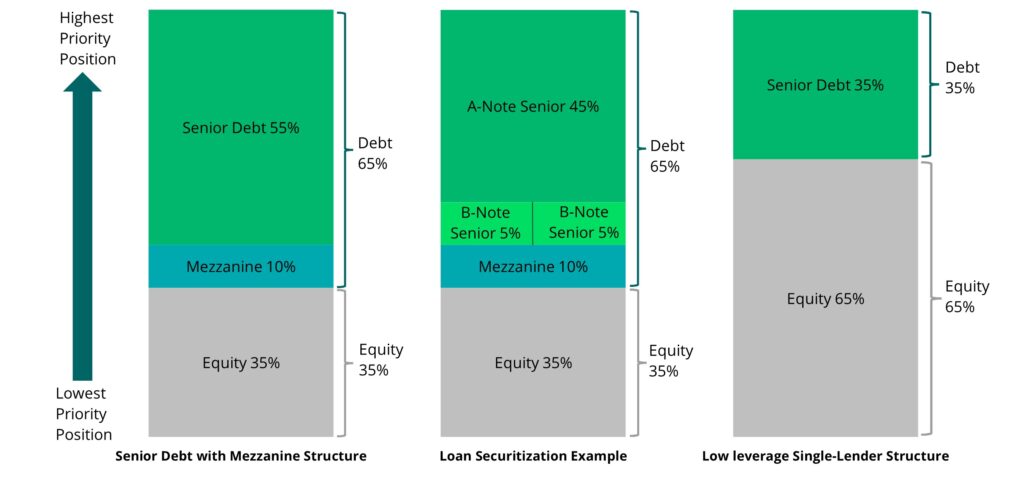

Examples of Capital Stack in Commercial Real Estate Financing

What are the Common Subclasses?

Explore Private Markets Further

Explore select private market asset classes to understand better what they are, who uses them, and the potential to identify value.

Explore Private Real Estate Asset Classes

Explore select private market asset classes to understand better what they are, who uses them, and the potential to identify value.

The information herein is provided for educational purposes only and should not be construed as financial or investment advice, nor should any information in this document be relied on when making an investment decision. Opinions and views expressed reflect the current opinions and views of the author(s) and Bridge Analysts as of the date hereof and are subject to change at any time without notice. Please see the end of this document for important disclosure information.

Important Disclosure Information

This material is for educational purposes only and should not be treated as research. This material may not be distributed, transmitted or otherwise communicated to others, in whole or in part, without the express written consent of Bridge Investment Group Holdings LLC (together with its affiliates, “Bridge”).

The views and opinions expressed in this material are the views and opinions of the author(s) of the material. They do not necessarily reflect the views and opinions of Bridge and are subject to change at any time without notice. Further, Bridge and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views expressed in this material. There can be no assurance that an investment strategy will be successful. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially and should not be relied upon as such. Target allocations contained herein are subject to change. There is no assurance that the target allocations will be achieved, and actual allocations may be significantly different than that shown here.

This material does not constitute an offer of any service or product of Bridge. It is not an invitation by or on behalf of Bridge to any person to buy or sell any security or to adopt any investment strategy, and shall not form the basis of, nor may it accompany nor form part of, any right or contract to buy or sell any security or to adopt any investment strategy. Nothing herein should be taken as investment advice or a recommendation to enter into any transaction.

Hyperlinks to third-party websites in this material are provided for reader convenience only. Unless otherwise noted, information included herein is presented as of the dates indicated. This material is not complete, and the information contained herein may change at any time without notice. Bridge does not have any responsibility to update the material to account for such changes. Bridge has not made any representation or warranty, expressed or implied, with respect to fairness, correctness, accuracy, reasonableness, or completeness of any of the information contained herein, and expressly disclaims any responsibility or liability, therefore. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Investors should make an independent investigation of the information contained herein, including consulting their tax, legal, accounting or other advisors about such information. Bridge does not act for you and is not responsible for providing you with the protections afforded to its clients.

Certain information contained herein may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such information. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Any reference to indices, benchmarks, or other measure of relative market performance over a specified period of time are provided for context and for your information only.

Past performance is not necessarily indicative of future results.

Additional information may be available upon request.

© 2025 Bridge Investment Group Holdings LLC. “Bridge Investment Group” and certain logos contained herein are trademarks owned by Bridge.

- Capital Stack: The capital stack is the financial structure of a commercial transaction. It includes all financing instruments, such as debt and equity, and who has rights to the property’s income and profits.

- Commercial Mortgage-Backed Securities (“CMBS”): CMBS are fixed-income investments backed by mortgages on commercial properties rather than residential real estate. CMBS are backed by longer-term fixed-rate loans.

- Commercial Real Estate Collateralized Loan Obligations (“CRE CLO”): CRE CLOs are structured as a hybrid of traditional leveraged bank loan CLOs and commercial mortgage-backed securities (CMBS). CRE CLOs are backed by shorter-term, floating rate CRE loans on transitional properties.

- Loan Covenants: A loan covenant is a clause in the loan agreement stipulating the terms and conditions of loan policies between a borrower and a lender.

- Conduit Structure: Conduit financing is a type of commercial real estate loan that involves pooling similar commercial mortgages together and selling them on the secondary market. Conduit loans are also known as CMBS loans.

- Loan Securitization (B-Note Pari Passu): In a pari passu structure, a sponsor may split a CMBS loan into A-notes and B-notes. B-note is a form of subordinate financing that is secured by the same mortgage as an A-note but is subordinated to it under an Intercreditor Agreement.

- Loan-to-Value Ratio (“LTV”): Loan-to-value ratio is a financial term that compares the amount of a loan to the appraised value of a property. It’s calculated by dividing the principal of a mortgage loan by the value of the property.

- Market Dislocation: A financial market dislocation is a situation where financial markets are unable to correctly price assets in both absolute and relative terms due to stressful macro or market-related conditions.

- Prime Rate: The prime rate, as reported by The Wall Street Journal’s bank survey, is amongst the most widely used benchmark in setting home equity lines of credit and credit card rates. It is in turn based on the federal funds rate, which is set by the Federal Reserve.

- Secured Overnight Financing Rate (“SOFR”): The Secured Overnight Financing Rate (SOFR) is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities.

- Securitized Debt: Securitization is a process that involves transferring mortgages or loans to third parties by issuing debt that is backed by the original debt pool’s cash-flows.

i Commercial/Multifamily Quarterly Databook, Q3 2024. Mortgage Bankers Association (MBA).

ii Commercial/Multifamily Quarterly Databook, Q3 2024. Mortgage Bankers Association (MBA).

iii Trepp, Inc., based on Federal Reserve Flow of Funds, as of Q3 2024.

ON THIS PAGE…