industrial Net Lease

Key Takeaways

net lease

Durable Income

Industrial Upside

What is industrial net lease real estate?

Who uses industrial real estate?

Online Manufacturers

Engage in the production and assembly of new products on a large scale. Vehicles and auto parts rank as one of the largest categories of US manufacturing.

Food Processors

Prepare raw agricultural products for final consumption, a critical, needs-based activity that shelters the subsector from broader macro volatility.

Retailers

Rely on expansive networks of warehouses to supply stores and to meet growing consumer expectations for quick, affordable product delivery.

Logistics providers

Move goods through the supply chain in industrial real estate including warehouses, truck terminals and industrial outdoor storage facilities.

What are the common building types?

Logistics

Facilities including warehouse and distribution centers, truck terminals, and industrial outdoor storage facilities, that support the storage and movement of goods from factories to end consumers.

Manufacturing

Facilities contain assembly lines and advanced machinery to produce intermediate and finished goods.

Cold Storage

Food supply chain facilities that could include canneries or bakeries. Cold storage is also a key part of food supply chains with refrigerated areas for perishable items.

Light Industrial Buildings

Includes flex buildings, R&D buildings, and specialized manufacturing properties are multiuse buildings that include warehousing, office space, and manufacturing areas. They are typically located in business parks.

What are the secular drivers for industrial?

- Ecommerce: Online spending continues to accelerate, and total annual sales have jumped nearly 96% over the past five years to $1.2 trillion. As shoppers increasingly gravitate toward digital outlets, online sales are expected to continue climbing.ii

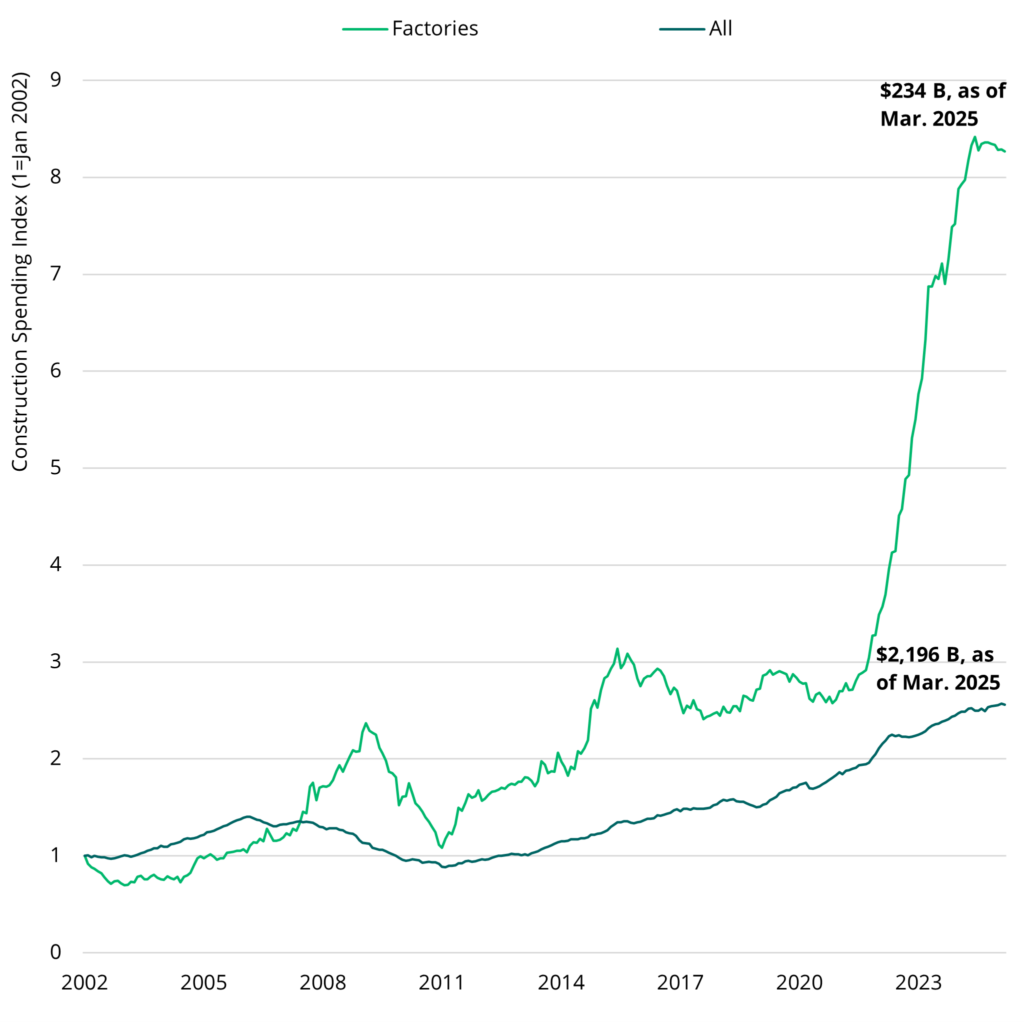

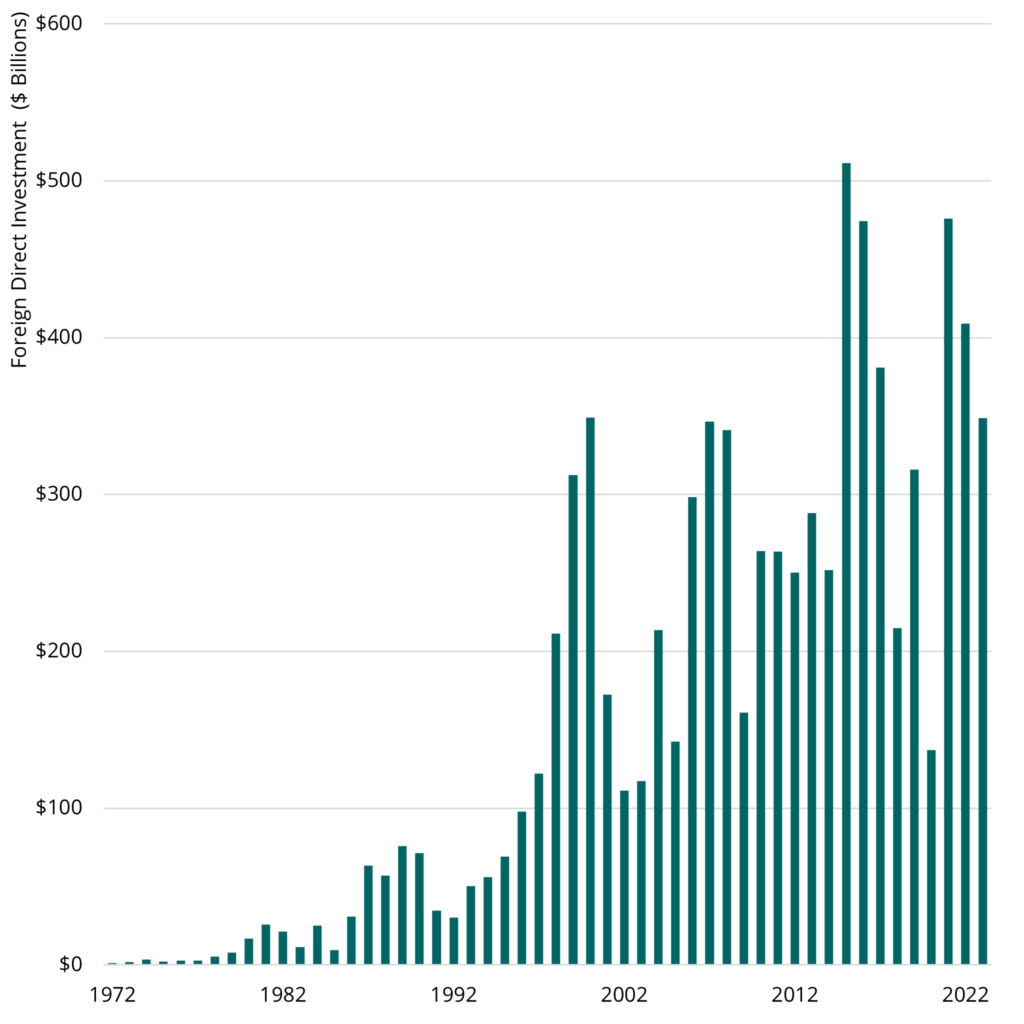

- Manufacturing Investment: The US is experiencing a surge in advanced manufacturing investment that is expanding industrial capacity. Construction spending on new factories has jumped 205% since the end of 2018, far outpacing expenditures on other building types.iii The US is the top destination for foreign direct investment, which is primarily flowing into goods-producing sectors in part because of new federal measures to invigorate domestic manufacturing.iv

- Limited Supply: Limited supply and muted new industrial development activity should keep industrial fundamentals stable. National industrial vacancy is approximately 7% today and is forecast to drift higher through 2025 to approximately 7.3%, levels that historically have supported strong rent growth.

Spending on US Factory Construction is Surgingv

The US is Capturing an Outsized Share of Global Capitalvi

How are net lease contracts different?

Commercial real estate leases are legally binding contracts between a property owner and a tenant. The amount of rent a tenant pays is determined through negotiation, and net leases often include provisions for fixed contractual increases in rents at regular intervals (typically annually) during the lease term.

Net leases also dictate who will pay for operating and capital costs associated with the property. These typically fall into one of three primary categories:

- Property taxes charged by local governments are based on the appraised value of the property.

- Insurance includes premiums and deductibles for policies that provide protection against property damage, theft, or liability.

- Operating expenses include utilities, cleaning, landscaping, snow removal, and other day-to-day operating costs necessary to run a tenant’s business in the facility.

- Maintenance, repairs and capital expenditures can include both recurring property maintenance costs, repairs, such as fixing a leak in a roof, or capital expenditures, such as replacing the parking surface or the roof mebrane.

Leases that transfer responsibility for most, if not all of these cost items onto the tenant are known as net leases, or triple net leases (“NNN”). In contrast, gross leases require the building owner to manage and pay some if not all of the building costs (e.g., real estate taxes, insurance, operating expenses, maintenance, repair, and capital expenditures).

Regardless of lease type, owners maintain title to the property and must pay to service any loans that are tied to the asset.

Net leases shift operating costs onto tenants

|

Expense Item |

Gross |

Single Net |

Double Net |

Triple Net |

Absolute Net |

|---|---|---|---|---|---|

|

Property Taxes |

ⓧ |

✔ |

✔ |

✔ |

✔ |

|

Building Insurance |

ⓧ |

ⓧ |

✔ |

✔ |

✔ |

|

Regular Maintenance |

ⓧ |

ⓧ |

ⓧ |

✔ |

✔ |

|

Structural Repairs |

ⓧ |

ⓧ |

ⓧ |

ⓧ |

✔ |

Decreasing Landlord Capital Exposure to Risk and Volatility

Explore Private Markets Further

Explore select private market asset classes to understand better what they are, who uses them, and the potential to identify value.

Explore Private Real Estate Asset Classes

Explore select private market asset classes to understand better what they are, who uses them, and the potential to identify value.

The information herein is provided for educational purposes only and should not be construed as financial or investment advice, nor should any information in this document be relied on when making an investment decision. Opinions and views expressed reflect the current opinions and views of the author(s) and Bridge Analysts as of the date hereof and are subject to change at any time without notice. Please see the end of this document for important disclosure information.

Important Disclosure Information

This material is for educational purposes only and should not be treated as research. This material may not be distributed, transmitted or otherwise communicated to others, in whole or in part, without the express written consent of Bridge Investment Group Holdings LLC (together with its affiliates, “Bridge”).

The views and opinions expressed in this material are the views and opinions of the author(s) of the material. They do not necessarily reflect the views and opinions of Bridge and are subject to change at any time without notice. Further, Bridge and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views expressed in this material. There can be no assurance that an investment strategy will be successful. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially and should not be relied upon as such. Target allocations contained herein are subject to change. There is no assurance that the target allocations will be achieved, and actual allocations may be significantly different than that shown here.

This material does not constitute an offer of any service or product of Bridge. It is not an invitation by or on behalf of Bridge to any person to buy or sell any security or to adopt any investment strategy, and shall not form the basis of, nor may it accompany nor form part of, any right or contract to buy or sell any security or to adopt any investment strategy. Nothing herein should be taken as investment advice or a recommendation to enter into any transaction.

Hyperlinks to third-party websites in this material are provided for reader convenience only. Unless otherwise noted, information included herein is presented as of the dates indicated. This material is not complete, and the information contained herein may change at any time without notice. Bridge does not have any responsibility to update the material to account for such changes. Bridge has not made any representation or warranty, expressed or implied, with respect to fairness, correctness, accuracy, reasonableness, or completeness of any of the information contained herein, and expressly disclaims any responsibility or liability, therefore. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Investors should make an independent investigation of the information contained herein, including consulting their tax, legal, accounting or other advisors about such information. Bridge does not act for you and is not responsible for providing you with the protections afforded to its clients.

Certain information contained herein may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such information. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Any reference to indices, benchmarks, or other measure of relative market performance over a specified period of time are provided for context and for your information only.

Past performance is not necessarily indicative of future results.

Additional information may be available upon request.

© 2025 Bridge Investment Group Holdings LLC. “Bridge Investment Group” and certain logos contained herein are trademarks owned by Bridge.

- Business Park: A planned area developed specifically to accommodate offices, warehouses, or light industrial facilities for multiple businesses.

- Capital Expenditures: Investments made to acquire, improve, and maintain an asset.

- Commercial Real Estate: Refers to properties used for business-related purposes that can generate rental income and offer potential upside through capital appreciation.

- Flex Buildings: Commercial properties designed for flexible uses, often combining office, warehouse, and light manufacturing space.

- R&D Buildings: Facilities specifically designed for research and development activities, often equipped with labs, offices, and testing areas.

- Specialized Manufacturing Properties: Industrial buildings tailored for specific manufacturing processes or equipment, often not easily repurposed for other uses.

i CoStar, as of Q1 2025.

ii Moody’s Analytics, Baseline Scenario, as of May 2025.

iii US Census Bureau via FRED, Construction Spending, as of March 2025.

iv The World Bank, DataBank, 2025.

v US Census Bureau via FRED, Construction Spending, as of March 2025.

vi The World Bank, DataBank, 2025.

ON THIS PAGE...