LOGISTICS

Key Takeaways

Logistics

Properties

Asset Value

What is logistics real estate?

Who uses logistics real estate?

Online Retailers

Sell products primarily through digital outlets. As shopping habits evolve, the industry continues to rapidly expand. Amazon ranks as the largest online retailer in the US and rents hundreds of logistics facilities nationwide.i

Big Box Retailers

Rely on expansive networks of warehouses to supply stores. Many of these companies have developed online platforms to complement their physical footprints. Prominent examples include Walmart and Target.

Third-party Logistics

Firms, such as FedEx and UPS, that specialize in providing outsourced logistics services, including transportation, inventory management, and order fulfillment.

More than 61 million parcels pass through logistics buildings each day in the USii

What are the secular drivers for the sector?

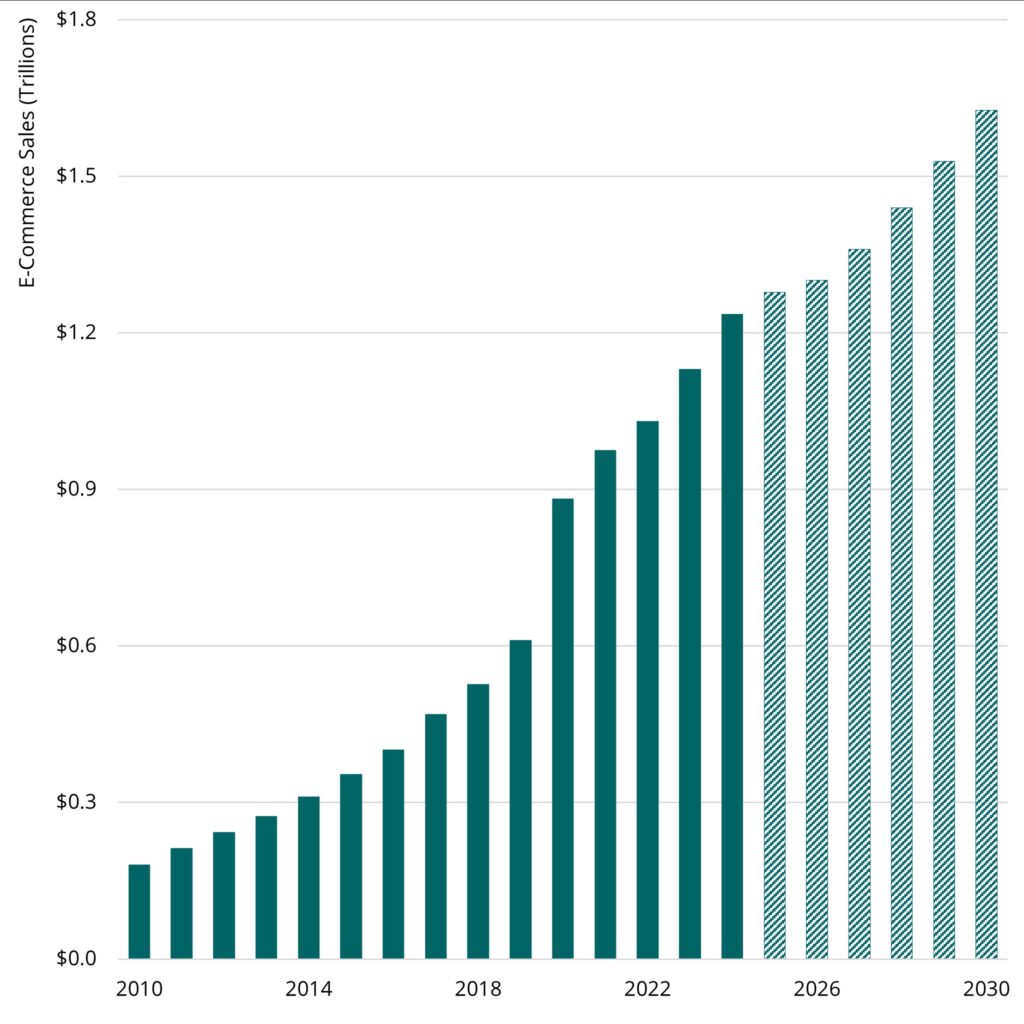

- Online spending, which requires three times as much warehouse space as traditional retail sales,iii continues to accelerate, and total annual sales have nearly doubled over the past five years to $1.2 trillion.iv As shoppers increasingly gravitate toward digital outlets, online sales are expected to continue climbing.v

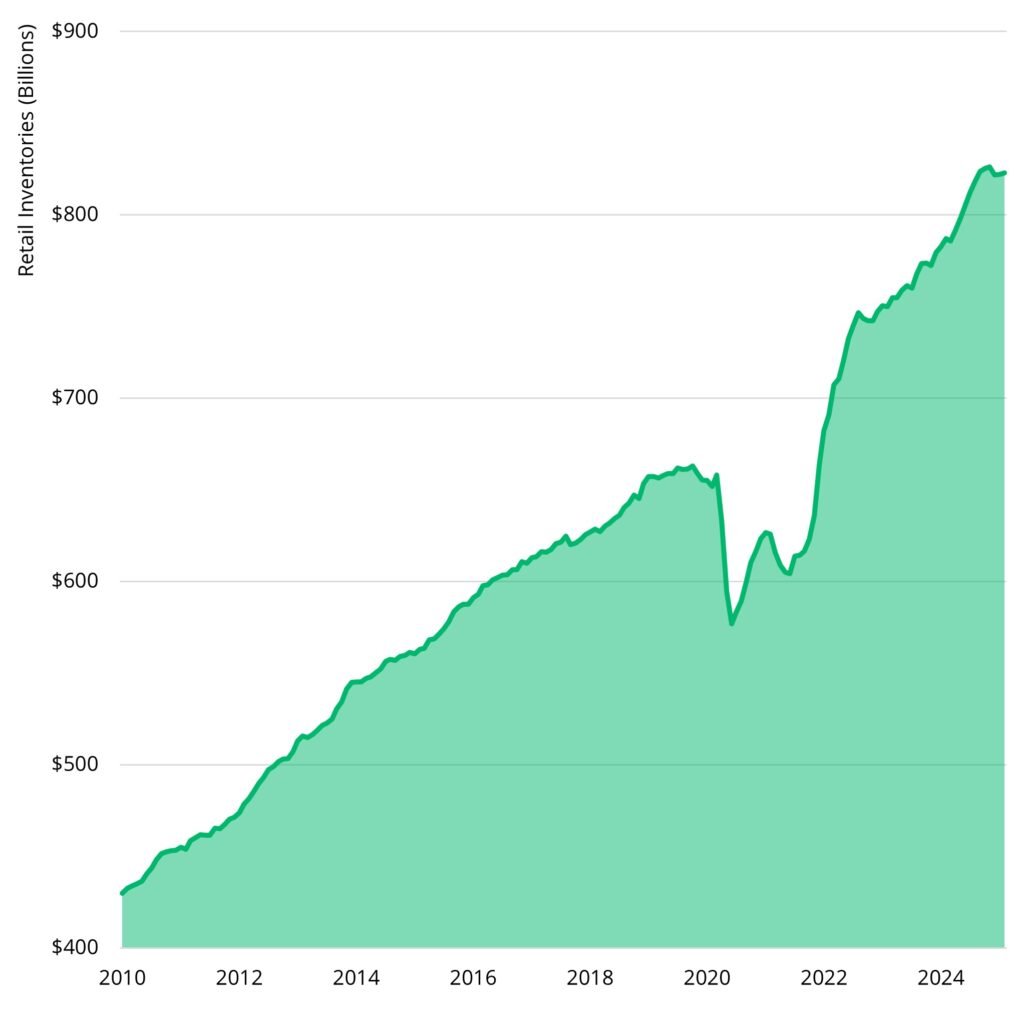

- Business inventories continue to climb steadily, deepening the need for storage space. Retail inventories increased more than 25% from the end of 2019 to the beginning of 2025.vii

- International trade brings in more than $840 billion worth of raw materials, intermediate goods, and finished goods into the US each year.ix Cities with major seaports are outgrowing current logistics properties and are looking to expand their logistics footprint.

Online Retail Spending Projected to Continue Acceleratingvi

Retail Inventories Have Rebounded from a Pandemic Dip and Are Still Climbingviii

What are the common building types?

Logistics properties are typically designed for a specific purpose and operating type, where loading/unloading, storage, and vehicle access determine optimal building use. Most logistics properties are single-story buildings with low maintenance costs and basic finishes.

Bulk Distribution Warehouses

(Typical Size: 750k+ SF) Serve as distribution hubs that service large geographic regions. Distribution centers can cover the equivalent of several football fields and are strategically located along highways on the outskirts of major cities.

Last-Mile Fulfillment Centers

(Typical Size: Varies) Represent the last step of the supply chain before products reach the consumer. These facilities are often found near highly populated areas to meet shopper expectations for next-day and same-day shipping.

Flex/R&D Buildings

(Typical Size: Varies) Multiuse spaces that include warehousing and light manufacturing, and they are typically located in business parks.

Specialty Logistics Buildings

(Typical Size: 25k-200k SF) Cater to specific user needs. Specialty logistics include truck terminals for loading and unloading, and cold storage sites for perishable items.

How is value created at the asset level?

- Create Efficiencies: Additional doors and loading docks can translate into faster product throughput, while expanded parking can support more workers and bigger semi-trucks.

- Technology: Many logistics tenants prioritize buildings that support state-of-the-art robotics and automation technology to streamline operations.

- Go vertical: Taller ceilings can meaningfully increase total storage area and are most economical when buildable land is scarce and expensive.

Explore Private Markets Further

Explore select private market asset classes to understand better what they are, who uses them, and the potential to identify value.

Explore Private Real Estate Asset Classes

Explore select private market asset classes to understand better what they are, who uses them, and the potential to identify value.

The information herein is provided for educational purposes only and should not be construed as financial or investment advice, nor should any information in this document be relied on when making an investment decision. Opinions and views expressed reflect the current opinions and views of the author(s) and Bridge Analysts as of the date hereof and are subject to change at any time without notice. Please see the end of this document for important disclosure information.

Important Disclosure Information

This material is for educational purposes only and should not be treated as research. This material may not be distributed, transmitted or otherwise communicated to others, in whole or in part, without the express written consent of Bridge Investment Group Holdings LLC (together with its affiliates, “Bridge”).

The views and opinions expressed in this material are the views and opinions of the author(s) of the material. They do not necessarily reflect the views and opinions of Bridge and are subject to change at any time without notice. Further, Bridge and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views expressed in this material. There can be no assurance that an investment strategy will be successful. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially and should not be relied upon as such. Target allocations contained herein are subject to change. There is no assurance that the target allocations will be achieved, and actual allocations may be significantly different than that shown here.

This material does not constitute an offer of any service or product of Bridge. It is not an invitation by or on behalf of Bridge to any person to buy or sell any security or to adopt any investment strategy, and shall not form the basis of, nor may it accompany nor form part of, any right or contract to buy or sell any security or to adopt any investment strategy. Nothing herein should be taken as investment advice or a recommendation to enter into any transaction.

Hyperlinks to third-party websites in this material are provided for reader convenience only. Unless otherwise noted, information included herein is presented as of the dates indicated. This material is not complete, and the information contained herein may change at any time without notice. Bridge does not have any responsibility to update the material to account for such changes. Bridge has not made any representation or warranty, expressed or implied, with respect to fairness, correctness, accuracy, reasonableness, or completeness of any of the information contained herein, and expressly disclaims any responsibility or liability, therefore. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Investors should make an independent investigation of the information contained herein, including consulting their tax, legal, accounting or other advisors about such information. Bridge does not act for you and is not responsible for providing you with the protections afforded to its clients.

Certain information contained herein may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such information. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Any reference to indices, benchmarks, or other measure of relative market performance over a specified period of time are provided for context and for your information only.

Past performance is not necessarily indicative of future results.

Additional information may be available upon request.

© 2025 Bridge Investment Group Holdings LLC. “Bridge Investment Group” and certain logos contained herein are trademarks owned by Bridge.

- Business Park: A planned area developed specifically to accommodate offices, warehouses, or light industrial facilities for multiple businesses.

- Distribution Networks: The system of warehouses, transportation methods, and logistics partners used to move goods from producers to retailers or customers.

- Online Retail Spending: The amount of money consumers spend on purchasing goods and services through internet-based stores and platforms.

- Retail Inventories: The total amount of goods and products that a retail business keeps in stock for sale to customers.

i CoStar, as of Q1 2025.

ii Pitney Bowes, Parcel Shipping Index Report, 2024.

iii Green Street, US Industrial Outlook, January 28, 2025.

iv Moody’s Analytics, Baseline Scenario, as of May 2025.

v Moody’s Analytics, Baseline Scenario, as of May 2025.

vi Moody’s Analytics, Baseline Scenario, as of May 2025.

vii US Census Bureau via FRED, Manufacturing and Trade Inventories and Sales, as of February 2025.

viii US Census Bureau via FRED, Manufacturing and Trade Inventories and Sales, as of February 2025.

ix US Bureau of Economic Analysis via FRED, US International Transactions, as of Q4 2024.

ON THIS PAGE...