Updating Our Outlook for US Real Estate Markets:

Putting Conviction into Action

OUR OUTLOOK FOR US REAL ESTATE MARKETS IN 2H 2023

In our midyear update to our 2023 Outlook, our central theme of Conviction is evolving appropriately to Putting Conviction into Action. A few core observations drive our update. Over the last several months, we have seen improvement in the macroeconomic environment and activity levels in the commercial real estate sector are starting to recover. The global outlook has softened in many major economies, and the US economy continues to demonstrate that it is the preeminent destination for investment globally. Regional banking turbulence from last quarter did not put an end to the economic expansion, nor did it signal the beginning of a systemic crisis. We view these, among other notable indicators, as supportive of enthusiasm for the second half of 2023 and measured optimism for 2024.

Reviewing the global macroeconomic outlook, the US stands out among major global peers both on a relative and absolute basis. In 2Q 2023, US GDP grew by 2.4%, outpacing IMF growth projections and reinforcing the continued strength of the US economy amid a turbulent global economy. [1][2] By the IMF’s projections, the US is expected to have one of the highest growth rates compared to other major developed economies, with projections for absolute growth improving by 80 bps over the past year.

The strength of the US economy is a rising tide that lifts many boats, and we see select opportunities emerging in carefully curated sectors, markets, and product types. As we see early signs of green shoots, including increasing opportunities in US commercial real estate, our emphasis on conviction, which we define as being disciplined and selective in the current environment, was the appropriate bearing in navigating choppy waters, especially as the US economy continues to evolve.

Headline Inflation Levels of Developed Nations [3]

Central Banks’ Monetary Policy Tightening Is Proving Effective [4]

We expect central bank policy to remain tight, even as inflation has started to taper off after reaching historically high levels. A key indicator, in our view, is that core CPI minus shelter stands at 2.5% year-over-year compared to the peak in February of 2022 at 7.6%. [5] And despite the addition of tightening financial conditions over the past year, restrictive monetary policy has not yet resulted in a severe or rapid deceleration of growth, nor has it compromised a strong labor market.

Consumer confidence is improving, and consumer activity continues to bolster the economy’s momentum. As a result, we have seen stronger-than-expected domestic growth amid meaningful deceleration of inflation. Due to this, we have started to see a transition from how high will rates go to how long will they stay where they are. As a base case, we expect to be operating in a higher-for-longer rate environment through the next several quarters.

The most direct takeaway from the rapid tightening of global monetary policy is that a different interest rate paradigm is required to invest successfully going forward, one that focuses on the investment merits of selected asset classes and creating alpha at the asset level. As transaction activity returns and the shift towards a higher-for-longer mentality takes hold, we remain enthusiastic about the resilience of US commercial real estate, and more specifically, the thematic-driven investing that capitalizes on needs-based and consumer-driven sectors such as housing and logistics.

ACKNOWLEDGING THE CHALLENGES TO CONVICTION

The perception of risk and economic dislocation is, in our view, overstated by conventional indicators due to the rapid rise in rates in less than two years. For example, conventional US recession indicators, such as an inverted yield curve and the Leading Economic Index or “LEI,” conflict with the robust US economy and strong labor market. Both the yield curve and LEI have turned negative prior to recent financial crises. However, as both are heavily influenced by the rapid rise in rates, we believe this diminishes their ability to be accurate in the current set of conditions.

3MO/10Y Treasury Spread: Flashing Yellow Light [6]

Leading Economic Index: Challenges Ahead [7]

Within these views, we emphasize that conviction does not mean a disregard for vigilance—if anything there is a heightened sense of careful planning until lower volatility returns. Accordingly, the rapid rise in rates has had consequences for how investors perceive their alternative investment allocations:

-

Relative value has narrowed as fixed income, particularly short-term Treasuries, offer compelling yield. The convergence of equity and debt returns, and general market uncertainty have created outsized demand for fixed income products and many investors have adopted a wait-and-see approach as it relates to equity investments.

-

The rising cost of debt weighs on current yield and real estate valuations. However, at the same time, lower valuations creates potentially attractive, lower basis entry points. In our view, managers with ample dry powder and a keen focus on distress in the market are exceptionally well positioned during this period of volatility.

-

While fixed income yield has become more attractive on a relative basis, we believe that a balanced portfolio will allow investors to earn attractive current yield and be able to benefit from the near-term dislocation in the real estate market.

Short-term Treasury Yields Challenge All Other Asset Classes [8]

.png)

TURNING CONVICTION INTO ACTION: IDENTIFYING RESILIENCE IN THE US ECONOMY

In our enthusiasm about the positive momentum of the US economy and the implications for commercial real estate, we acknowledge that the turbulence of the first half of the year is not far in the rearview mirror. However, our concerns about volatility in the long-term have subsided modestly. Our focus is on navigating the complexities of an evolving US economy, which we recognize still faces challenges ahead.

.png)

US Household Balance Sheet [9]

Accounting for approximately two-thirds of US GDP, the financial health of the US consumer is critically important to the US economy. [10] US consumers continue to contribute positively to sustained economic momentum. Drawing from the reservoir of excess savings amassed in 2020 and 2021, consumers’ activities have provided much needed buoyancy to the economy broadly. However, as we delve deeper into the data, there's a trend that cannot be overlooked: these savings are approaching depletion. [11]

Dwindling excess savings highlights a potential weak spot in the economic foundation. This diminishing financial safety net puts consumers in a precarious position, where their spending power and financial resilience might be tested in the face of unexpected economic challenges.

Despite the potential challenges, however, we continue to see consumer activity increase in recent data, particularly for online spending. Combined with increasing investment in reshoring and in domestic advanced manufacturing, we see positive implications for the industrial and logistics sector.

Job Openings Far Exceed Available Labor [12]

Prime Age Labor Force Participation Rate Near Historic High [13]

Related to the overall health of US consumers, labor markets continue to be tight with robust hiring over the past few years. While we have observed some deceleration in hiring over the past several months, hiring remains elevated relative to the previous cycle’s long-term average. Unemployment hangs at 3.5% as of July 2023, indicating that the US is well past maximum employment. [14] Overall, a strong labor market reinforces the foundation of the economy, but the prolonged tightness has contributed to wage pressures. Recently, nominal wage growth has slowed, but at 4.5% the employment cost index, for example, is approximately twice the previous cycle’s long-term average. [15] With regard to US households as the principal drivers of the US economy, these data suggest continued momentum amid a decelerating inflationary environment.

The US housing market is another key driver of the US economy, accounting for approximately 15-18% of US GDP. [16] The housing sector has, in many respects, surpassed expectations given some of the regulatory and supply chain challenges starting in 2020. In Q3 2023, higher interest rates and benchmark yields for mortgages have resulted in emerging supply constraints for single-family homes, and a deceleration for new construction in both single-family and multifamily product. For context we see a deceleration of permitting activity of approximately 19% and 23%, respectively, from January 2022 levels, which was just before the Fed started raising rates. [17]

We see the decision to raise rates so quickly as having the unanticipated effect of reducing the forward pipeline of residential construction such that supply constraints are likely to emerge during the second half of 2024 and extend well through 2025. We believe this will provide lift both to rent levels and to capital appreciation for residential assets across markets and product segments.

WHERE WE SEE THE OPPORTUNITY SET

On a go-forward basis, we see two major themes for turning conviction into action: coming out of a depressed period of transaction activity, we believe we will see a generational buying opportunity; and continued dislocation and volatility in debt and equity markets contribute to the attractiveness of alternatives, particularly commercial real estate.

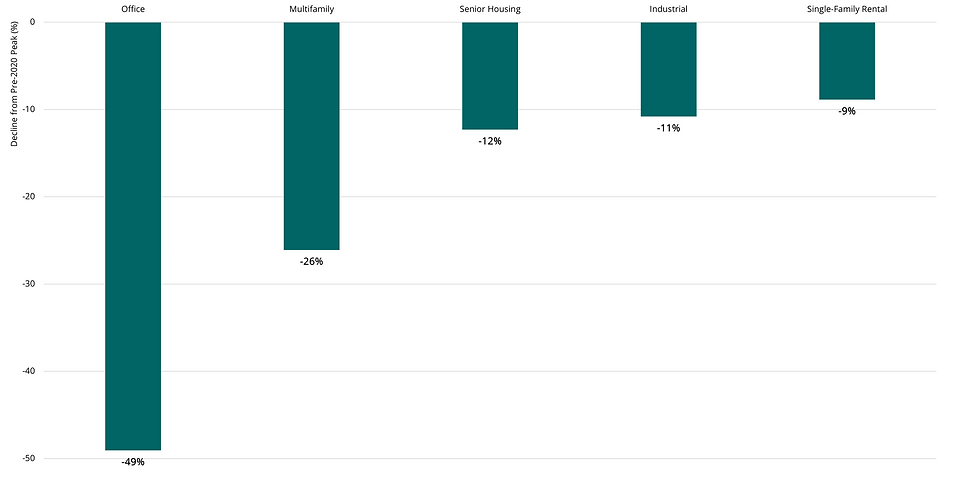

Unlike some other asset classes, commercial real estate values have reset significantly from their peaks, providing an attractive entry point. Our analysis of data from Green Street’s Commercial Property Price Index, same-store commercial real estate values for the Single-Family Rental, Industrial, and Seniors Housing sectors are down by 9-12% from their prior high-water mark over the last five years, Multifamily is down by as much as 26%, and Commercial Office values have declined by nearly 50%.[18]

Same-store Valuations Are Down from Pre-2020 Peak Levels [19]

.png)

In our view, resetting values in an elevated rate environment—particularly one that is likely to persist for some time—will result in opportunistic situations for many commercial real estate assets nearing their debt maturity wall. While some assets are distressed as a product of poor selection or ineffective management (and are therefore not attractive in this environment), we believe we will see high quality assets with distressed capital structures become available at attractive discounts to pre-market dislocation valuations. Such assets are likely to be viewed favorably when the market recovers, and, with over $180 billion of real estate dry powder in North American-focus real estate funds today, we anticipate market competition will likely narrow the currently-wide bid ask spread. [20]

Moving forward, we expect to see attractive and compelling opportunities as motivated selling and liquidity-induced distress manifests. Further, we believe that as debt markets stabilize and the higher for longer paradigm takes hold, values and transaction volumes will improve, leading to less variance in pricing and more conviction in the US real commercial estate market.

Sources

-

U.S. Bureau of Economic Analysis, as of Q2 2023

-

International Monetary Fund, World Economic Outlook Update, July 2023

-

Bloomberg, as of Aug 18, 2023.

-

Bloomberg, as of Aug 18, 2023.

-

Bloomberg, U.S. Bureau of Labor Statistics, as of August 2023. Not Seasonally Adjusted Data

-

Bloomberg, as of July 2023.

-

Bloomberg. The Conference Board, as of July 2023.

-

Bloomberg, as of August 23, 2023.

-

The Board of Governors of the Federal Reserve, Z, Financial Accounts of the United States, Bloomberg, as of August 2023.

-

U.S. Bureau of Economic Analysis, Shares of gross domestic product: Personal consumption expenditures, retrieved from FRED, as of August 2023

-

The Board of Governors of the Federal Reserve, Z, Financial Accounts of the United States, Bloomberg, as of August 2023

-

Bloomberg. US Bureau of Labor Statistics, as of July 2023.

-

Bloomberg. Bureau of Labor Statistics, as of July 2023.

-

Bloomberg. U.S. Bureau of Labor Statistics, as of July 2023

-

U.S. Bureau of Labor Statistics, News Release Employment Cost Index, as of July 28, 2023 (https://www.bls.gov/news.release/pdf/eci.pdf)

-

National Association of Home Builders, as of Q2 2023

-

US Census Bureau, Department of Housing and Urban Development (HUD), Building Permits Survey, as of August 2023

-

Green Street, Commercial Property Price Index (“CPPI”), as of August 2023.

-

Green Street, Commercial Property Price Index (“CPPI”), as of August 2023. Green Street Proprietary Data

-

Preqin, as of August 20, 2023. Data includes Opportunistic and Value Added real estate equity funds only.

Disclosures

© 2023 Bridge Investment Group Holdings LLC,

The information contained herein is for informational purposes only about the US real estate market and is not intended to be relied up on as a forecast, research, investment advice or an investment recommendation. Reliance upon the information in this material is at the sole discretion of the reader. Past performance is not necessarily indicative of future performance or results.

Bridge Research Department

This material has been prepared by the Research Department at Bridge Investment Group Holdings LLC (together with its affiliates, “Bridge”) in consultation with other investment professionals within Bridge. The Research Department is responsible for providing market research and analytics internally to Bridge’s private funds and verticals. The Research Department does not issue any independent research, investment advice or investment recommendations either internally or to the general public. Prior to publication, this material may have been discussed with or reviewed by persons outside of the Research Department.

No Distribution; No Offer for Solicitation

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Bridge.

This material is not and should not be considered an offer to sell any securities or the solicitation of an offer to purchase any securities. This material discusses broad market, industry, or sector trends, or other general economic, market, social, legislative, or political conditions and has not been provided in a fiduciary capacity under ERISA.

Forecasts and/or Estimated Returns

Economic and market forecasts or estimated returns presented in this material reflect the Research Department’s judgement as of the date of this material and are subject to change without notice. Although certain information has been obtained from third-party sources believed to be reliable, Bridge does not guarantee its accuracy, completeness, or fairness. Bridge has relied upon and assumed without independent verification, the accuracy and completeness of all information available from third-party sources. Some of this information may not be freely available and may require a subscription or a payment.

Any forecasts or return expectations are as of the date of material and are estimated and are based on market assumptions. These assumptions are subject to significant revision and may change materially as economic and market conditions change. Bridge or the Research Department have no obligation to provide updates or changes to these forecasts. This material includes forward-looking statements that involve risk and uncertainty. Statements other than statements of historical fact are forward-looking statements and include but are not limited to our opinions on governmental and central bank policy, our beliefs and convictions for the US real estate market and the US economy, our expectations regarding inflation, and our expectations regarding the direct impact of the financial market volatility related to bank failures on commercial real estate. Readers are cautioned not place undue reliance on such forward-looking statements.

Indices

Any reference to indices, benchmarks, or other measure of relative market performance over a specified period of time are provided for context and for your information only.

Tax Information

Bridge does not provide legal, tax, or accounting advice. Readers should obtain their own independent legal, tax or accounting advice based on their particular circumstances.