The U.S. Housing Market Has Entered Another Era of Rentership

Key Takeaways

Multifamily fundamentals are normalizing as annual demand approaches trend while supply pressures fade. New construction is decelerating meaningfully, occupancy is stabilizing across many markets, and visibility into forward supply conditions is improving.

Rentership is increasingly structural, not cyclical. The rent-versus-own calculus remains unfavorable for many households, reinforcing rental tenure as a durable component of the U.S. housing system.

In our view, an attractive window for disciplined capital deployment is emerging. Multifamily pricing has adjusted, cap rates appear more stable, and market-level differentiation is emerging.

The U.S. Housing Market Has Entered Another Era of Rentership

At the beginning of 2026, multifamily fundamentals are poised for a gradual normalization toward recovery. With new construction decelerating and occupancy stabilizing in many markets, we can see reemerging signs of structural undersupply. Investors returning to the sector with disciplined capital will likely find cap rates stabilized and select regional markets that offer attractive rent growth prospects. In our view, multifamily stands out as a core asset class for the potential for income stability and capital appreciation ahead of the next upcycle.

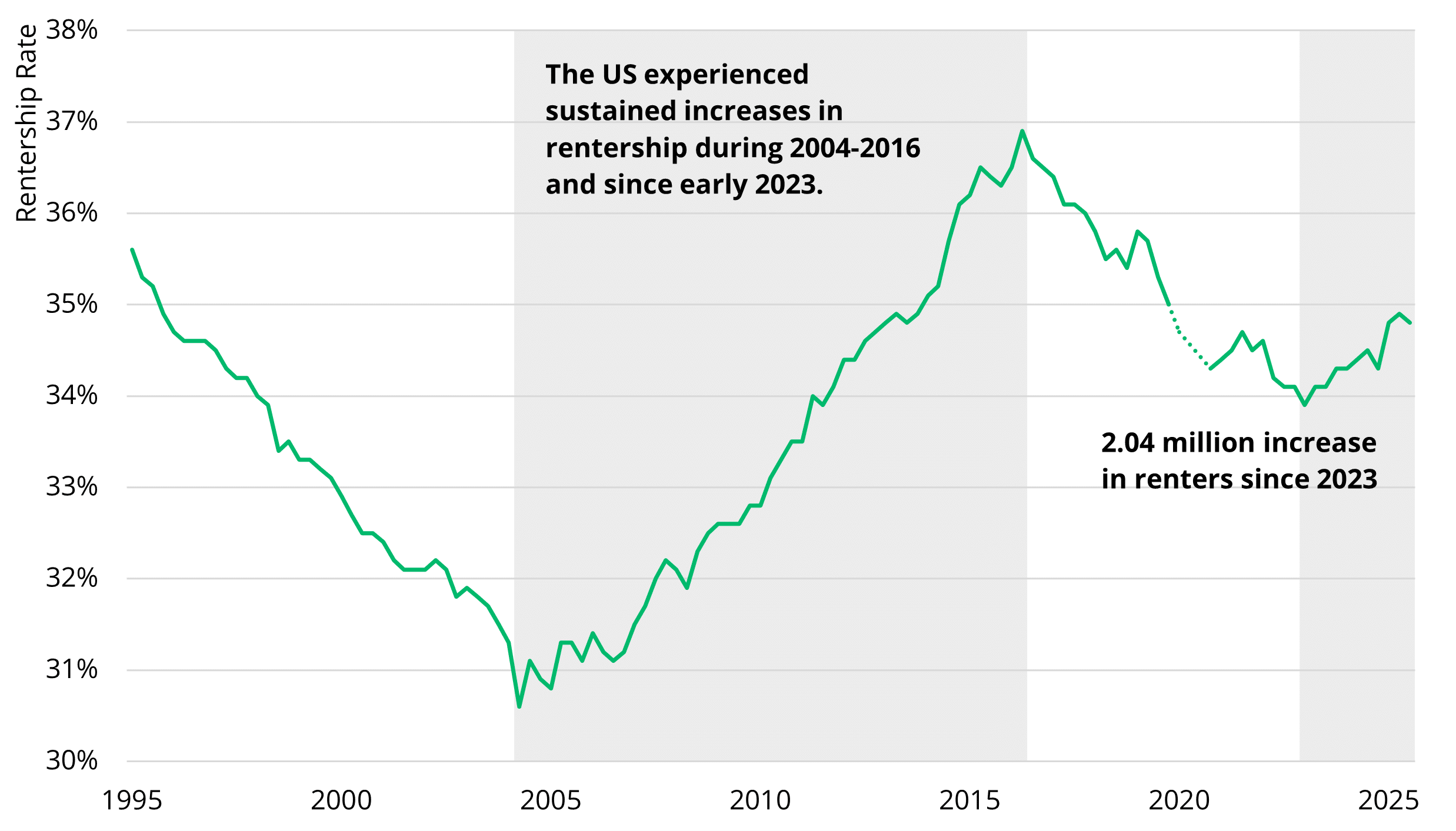

Signs of a recovery are unfolding against a broader, protracted shift in the U.S. housing system. We believe the market has entered another era of rentership—one defined by an altered rent-versus-own calculus that is fundamentally different than the post-GFC business cycle. The financial commitment required to own a home remains elevated, reflecting higher asset prices, financing costs, and rising ongoing expenses. As a result, the current environment makes a compelling case that renting is, for many households, a more efficient and flexible choice.

The economics are straightforward. Even as home price appreciation has moderated, the all-in cost of ownership remains historically high relative to renting. Mortgage payments, insurance, taxes, and maintenance continue to grow, while rental pricing—particularly within institutionally managed multifamily housing—has normalized as new supply has come online. This has helped restore balance to rent-to-income dynamics and improved rental affordability at the margin.

At the same time, the quality and availability of rental housing have materially improved. For households navigating an uncertain labor market, delayed family formation, or geographic mobility, renting increasingly aligns with lifestyle and financial priorities rather than serving as a transitional stopgap.

These themes are playing out as the housing market digests a late-cycle wave of multifamily deliveries. In the near term, elevated supply in select markets has weighed on rent growth and driven concessions. However, this period of adjustment is also serving an important role—allowing households to access higher-quality rental options and enabling markets to absorb inventory without compromising long-term fundamentals. In our view, the availability of institutional rental housing is helping many markets work through this phase efficiently.

Looking ahead, the construction pipeline is thinning meaningfully as higher construction costs and tighter capital conditions reduced the feasibility of many new developments. As supply growth decelerates and rental demand remains supported by both economic and lifestyle considerations, market conditions should gradually rebalance—particularly in markets that absorbed the bulk of recent deliveries.

The bottom line: in our view, the opportunity is clear. Pricing has adjusted, the outlook for new supply is improving, and long-term demand drivers are well established. We believe this is an attractive window to allocate capital to multifamily—capturing durable income today while positioning portfolios for

operating leverage and value creation as the next upcycle takes hold.

The U.S. Is Entering a New Era of Rentership1

1 U.S. Census Bureau via FRED, Housing Vacancies and Homeownership, Q3 2025.

subscribe to our market outlooks and sector insights

Disclosures

This material is for educational purposes only and should not be treated as research. This material may not be distributed, transmitted or otherwise communicated to others, in whole or in part, without the express written consent of Bridge Investment Group Holdings LLC (together with its affiliates, “Bridge”).

The views and opinions expressed in this material are the views and opinions of the author(s) of the material. They do not necessarily reflect the views and opinions of Bridge and are subject to change at any time without notice. Further, Bridge and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views expressed in this material. There can be no assurance that an investment strategy will be successful. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially and should not be relied upon as such. Target allocations contained herein are subject to change. There is no assurance that the target allocations will be achieved, and actual allocations may be significantly different than that shown here.

This material does not constitute an offer of any service or product of Bridge. It is not an invitation by or on behalf of Bridge to any person to buy or sell any security or to adopt any investment strategy, and shall not form the basis of, nor may it accompany nor form part of, any right or contract to buy or sell any security or to adopt any investment strategy. Nothing herein should be taken as investment advice or a recommendation to enter into any transaction.

Hyperlinks to third-party websites in this material are provided for reader convenience only. Unless otherwise noted, information included herein is presented as of the dates indicated. This material is not complete, and the information contained herein may change at any time without notice. Bridge does not have any responsibility to update the material to account for such changes. Bridge has not made any representation or warranty, expressed or implied, with respect to fairness, correctness, accuracy, reasonableness, or completeness of any of the information contained herein, and expressly disclaims any responsibility or liability, therefore. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Investors should make an independent investigation of the information contained herein, including consulting their tax, legal, accounting or other advisors about such information. Bridge does not act for you and is not responsible for providing you with the protections afforded to its clients.

Certain information contained herein may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such information. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Any reference to indices, benchmarks, or other measure of relative market performance over a specified period of time are provided for context and for your information only.

All rights to the trademarks and/or logos presented herein belong to their respective owners and Bridge’s use hereof does not imply an affiliation with, or endorsement by, the owners of these logos. This material may contain select images that are provided for illustrative purposes only and may not be representative of assets owned or managed by Bridge. Such images may include digital renderings or stock photos rather than actual photos of assets, residents or communities.

Past performance is not necessarily indicative of future results.

Additional information may be available upon request.

© 2026 Bridge Investment Group Holdings LLC. All Rights Reserved.

BGRT-20260126-5153959-16247236