The Inflection Point for U.S. Multifamily Markets

Executive Summary

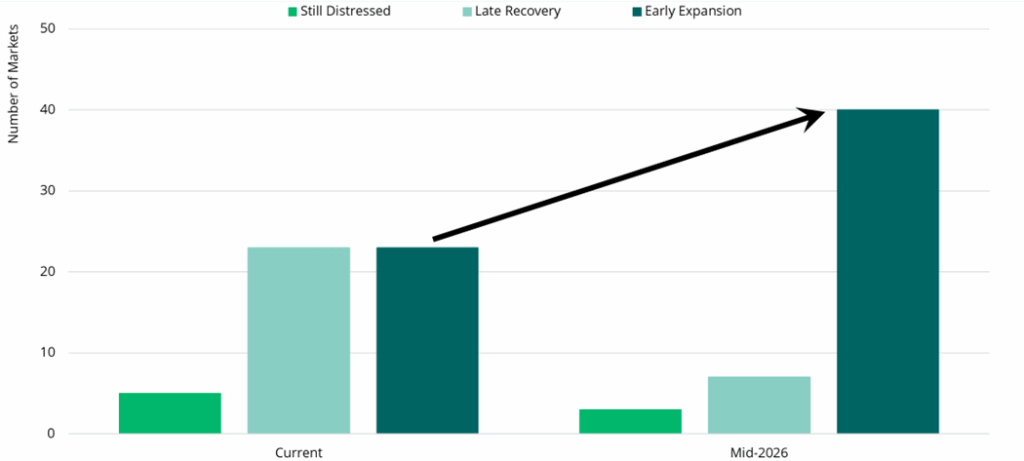

U.S. multifamily is moving steadily to an expansion phase of the cycle. Our analysis of the 50 largest markets shows nearly half are already in Early Expansion—occupancy is above historical levels and rent growth momentum is accelerating. By mid 2026, we expect 40 of 50 markets to be in this phase, assuming absorption trends track the 2017–2019 average (see the visual below).

What’s driving this shift?

- Demand has normalized: household formation and in‑migration to high‑growth markets continue; elevated ownership costs extend renter tenure.

- Supply is decelerating as the development pipeline rolls off, allowing occupancy to tighten and concessions to burn off.

- Fundamentals improve first where new supply has peaked, and employment remains resilient.

The Inflection Point in U.S. Multifamily Markets

Following a typical late-cycle supply surge and an associated decline in rent growth, many U.S. multifamily markets are entering an expansion phase in terms of fundamentals. Our market-by-market analysis of the 50 largest metros areas shows a transition from stabilization to growth—supporting our high conviction for the asset class.

We can segment markets into three phases: Still Distressed (where occupancy is below each market’s historical average and rents decline), Late Recovery (occupancy near average with flat to modest rent growth), and Early Expansion (occupancy above average with accelerating rent momentum). As of mid-2025, nearly half of the largest 50 markets are already in this Early Expansion phase. By mid-2026, Bridge analysts expect 40 of the 50 markets to enter Early Expansion, with accelerating rent growth and above-average occupancy, assuming absorption trends align with the 2017-2019 average. The accompanying visual illustrates this progression and the shrinking share of distressed markets.

Many of the Largest U.S. Metros Are Shifting to Expansion1

What is driving the turn? Demand has normalized as household formation and in-migration to high-growth markets continue, while elevated costs of homeownership keep renters in place longer. At the same time, new supply is decelerating quickly as the development pipeline rolls off. The result: occupancy continues to rise and rent concessions to burn off. As fundamentals improve, we anticipate rent growth will rebound from late-cycle lows—first in markets where new supply has crested and where employment remains resilient.

The implications for multifamily investing are clear, in our view. This is an opportune time in the cycle. Acquisitions in Late Recovery and Early Expansion markets can position portfolios to capture the next leg of net operating income (“NOI”) growth as occupancy moves above trend and leasing velocity improves. We believe further advantages to capturing value can be achieved through hands-on operations and asset management, while at the same time prioritizing submarkets with moderating deliveries and measurable absorption.

In our view, the cycle has turned. With almost half of major markets already in expansion—and the majority poised to join them by mid2026—the opportunity set in U.S. multifamily is compelling. We believe this is a crucial moment to lean into high-quality assets in submarkets with attractive fundamentals to capture value as the expansion gathers momentum.

1 RealPage as of August 2025

subscribe to our market outlooks and sector insights

Disclosures

The information herein is provided for educational purposes only and should not be construed as financial or investment advice, nor should any information in this document be relied on when making an investment decision. Opinions and views expressed reflect the current opinions and views of the author(s) and Bridge Analysts as of the date hereof and are subject to change at any time without notice. Please see the end of this document for important disclosure information.

Important Disclosure Information

This material is for educational purposes only and should not be treated as research. This material may not be distributed, transmitted or otherwise communicated to others, in whole or in part, without the express written consent of Bridge Investment Group Holdings LLC (together with its affiliates, “Bridge”).

The views and opinions expressed in this material are the views and opinions of the author(s) of the material. They do not necessarily reflect the views and opinions of Bridge and are subject to change at any time without notice. Further, Bridge and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views expressed in this material. There can be no assurance that an investment strategy will be successful. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially and should not be relied upon as such. Target allocations contained herein are subject to change. There is no assurance that the target allocations will be achieved, and actual allocations may be significantly different than that shown here.

This material does not constitute an offer of any service or product of Bridge. It is not an invitation by or on behalf of Bridge to any person to buy or sell any security or to adopt any investment strategy, and shall not form the basis of, nor may it accompany nor form part of, any right or contract to buy or sell any security or to adopt any investment strategy. Nothing herein should be taken as investment advice or a recommendation to enter into any transaction.

Hyperlinks to third-party websites in this material are provided for reader convenience only. Unless otherwise noted, information included herein is presented as of the dates indicated. This material is not complete, and the information contained herein may change at any time without notice. Bridge does not have any responsibility to update the material to account for such changes. Bridge has not made any representation or warranty, expressed or implied, with respect to fairness, correctness, accuracy, reasonableness, or completeness of any of the information contained herein, and expressly disclaims any responsibility or liability, therefore. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Investors should make an independent investigation of the information contained herein, including consulting their tax, legal, accounting or other advisors about such information. Bridge does not act for you and is not responsible for providing you with the protections afforded to its clients.

Certain information contained herein may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such information. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Any reference to indices, benchmarks, or other measure of relative market performance over a specified period of time are provided for context and for your information only.

Past performance is not necessarily indicative of future results.

Additional information may be available upon request.

© 2025 Bridge Investment Group Holdings LLC. “Bridge Investment Group” and certain logos contained herein are trademarks owned by Bridge.

ATLWAA-20250929-4853743-15313375