From Tonnage to Tenants: Freight Signals for Industrial Real Estate

Executive Summary

Freight activity offers a clear, fundamentals-driven lens on industrial real estate demand, making freight trends a useful early indicator of tenant demand. As local consumption represents an increasing share of freight, these dynamics suggest the next phase of the industrial cycle will be supported by steady goods movement and favoring well-located, modern warehouse assets positioned at the heart of domestic distribution.

Industrial demand ultimately follows the movement of goods, making warehouse-relevant freight volumes one of the most reliable leading indicators of where tenant demand and leasing momentum will emerge.

As freight growth in major U.S. metros becomes increasingly driven by local consumption, infill and near-consumer logistics assets are structurally advantaged, benefiting from durable demand and reduced exposure to global supply-chain volatility.

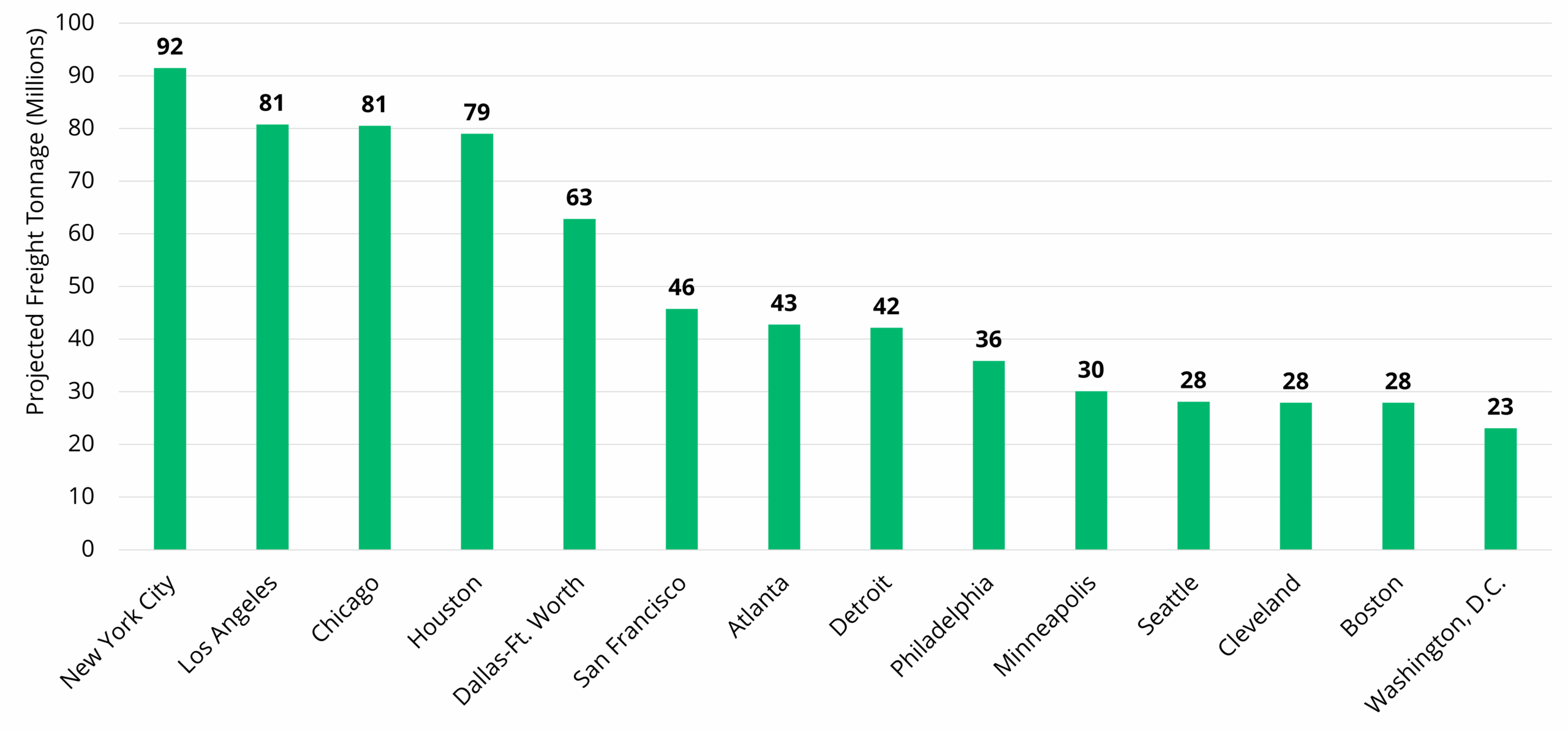

Even the largest U.S. freight hubs—including New York, Los Angeles, Chicago, Dallas, and Houston—derive an outsized share of volume from locally generated freight, underscoring the depth of consumer-driven demand and reinforcing the central role of last-mile logistics in top industrial markets

From Tonnage to Tenants: Freight Signals for Industrial Real Estate

We believe the geography of the next logistics cycle is embedded in freight activity. At its core, warehouse demand is freight-driven: goods must move, be stored, sorted, and delivered, and industrial real estate sits at the center of that system. While tenant preferences and capital markets conditions matter, freight volumes remain a foundational driver of long-run warehouse utilization.

In short, warehouses follow freight, both locally and nationally. Within metro areas, warehouses cluster near freight infrastructure—ports, interstates, railyards, and airports—which maximizes logistics efficiency. Similarly, regions that move more warehouse-relevant freight tend to support larger industrial footprints, even after controlling for population size.

Importantly, not all freight are equal for industrial real estate demand. It is important to differentiate between goods that typically flow through warehouses—consumer products, foodstuffs, and intermediate manufactured goods—rather than bulk commodities like coal, grain, or petroleum that bypass traditional warehouse networks. These warehouse-intensive goods are most closely aligned with logistics tenant demand.

This linkage has only been reinforced over recent years. Markets experiencing faster growth in freight volumes have generally seen stronger demand, suggesting freight activity can serve as an early signal for leasing momentum and likely demand pressure.

Another notable feature of today’s freight landscape is the growing importance of local activity, particularly in large urban freight zones. In the largest markets, a disproportionate share of freight is generated within the metro itself rather than passing through as long-haul transit.1 This locally generated demand tends to favor dense consumer bases, with e-commerce penetration reinforcing the increasing importance of last-mile and same-day delivery. In our view, this dynamic may provide a degree of insulation from global supply-chain disruptions while reinforcing the strategic value of infill and near-consumer logistics locations.

Looking ahead, freight fundamentals appear positioned to improve. After several years of headwinds tied to geopolitical tensions and uneven consumer demand, forecasts from the U.S. Bureau of Transportation Statistics point to broad-based growth in warehouse-related freight volumes across U.S. major metros (see accompanying visual). Growth is expected to be particularly strong in higher value-per-ton goods,2 which may favor modern, tech-enabled warehouses capable of supporting high-throughput operations.

Taken together, freight data suggest that the next phase of the industrial cycle is likely to be grounded less in speculative supply and more in the steady pull of

goods movement. For industrial real estate investors, we believe that following tonnage remains one of the most reliable ways to anticipate where tenants will ultimately land.

Consumer-based Freight Volumes Expected to Increase in Dense Urban Metros through 20303

1 Bureau of Transportation Statistics, Freight Analysis Framework, 2024.

2 Bureau of Transportation Statistics, Freight Analysis Framework, 2024.

3 Bureau of Transportation Statistics, Freight Analysis Framework, 2024.

subscribe to our market outlooks and sector insights

Disclosures

This material is for educational purposes only and should not be treated as research. This material may not be distributed, transmitted or otherwise communicated to others, in whole or in part, without the express written consent of Bridge Investment Group Holdings LLC (together with its affiliates, “Bridge”).

The views and opinions expressed in this material are the views and opinions of the author(s) of the material. They do not necessarily reflect the views and opinions of Bridge and are subject to change at any time without notice. Further, Bridge and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views expressed in this material. There can be no assurance that an investment strategy will be successful. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially and should not be relied upon as such. Target allocations contained herein are subject to change. There is no assurance that the target allocations will be achieved, and actual allocations may be significantly different than that shown here.

This material does not constitute an offer of any service or product of Bridge. It is not an invitation by or on behalf of Bridge to any person to buy or sell any security or to adopt any investment strategy, and shall not form the basis of, nor may it accompany nor form part of, any right or contract to buy or sell any security or to adopt any investment strategy. Nothing herein should be taken as investment advice or a recommendation to enter into any transaction.

Hyperlinks to third-party websites in this material are provided for reader convenience only. Unless otherwise noted, information included herein is presented as of the dates indicated. This material is not complete, and the information contained herein may change at any time without notice. Bridge does not have any responsibility to update the material to account for such changes. Bridge has not made any representation or warranty, expressed or implied, with respect to fairness, correctness, accuracy, reasonableness, or completeness of any of the information contained herein, and expressly disclaims any responsibility or liability, therefore. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Investors should make an independent investigation of the information contained herein, including consulting their tax, legal, accounting or other advisors about such information. Bridge does not act for you and is not responsible for providing you with the protections afforded to its clients.

Certain information contained herein may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such information. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Any reference to indices, benchmarks, or other measure of relative market performance over a specified period of time are provided for context and for your information only.

All rights to the trademarks and/or logos presented herein belong to their respective owners and Bridge’s use hereof does not imply an affiliation with, or endorsement by, the owners of these logos. This material may contain select images that are provided for illustrative purposes only and may not be representative of assets owned or managed by Bridge. Such images may include digital renderings or stock photos rather than actual photos of assets, residents or communities.

Past performance is not necessarily indicative of future results.

Additional information may be available upon request.

© 2026 Bridge Investment Group Holdings LLC. All Rights Reserved.

BGRT-20260113-5117930-16130362