Private Markets

Key Takeaways

Opportunities

Return Potential

Allocation

What are Private Markets?

Private Equity Funds

Invest in early-stage or mature firms that are not publicly traded. These companies could operate across a range of economic sectors and geographies.

Private Real Assets Funds

Purchase and manage residential and commercial properties, such as rental apartments and homes, advanced manufacturing facilities, warehouses, or infrastructure.

Private Credit Funds

Issue loans and other debt instruments, often to private, mid-sized companies.

Differences between Public and Private Markets

Private market strategies typically utilize longer-term investment approaches, choosing to focus on assets that mature over time and can take time to sell. As a result, it may be necessary to hold such investments for several years before a return is realized. Because of these longer investment horizons, investors may expect higher potential returns—known as an illiquidity premium—relative to asset classes that are more liquid, or easily converted to cash.

|

ASPECT |

PUBLIC MARKET |

PRIVATE MARKET |

|---|---|---|

|

Accessibility |

Issuance of stocks or bonds available to the general public including professional investors. |

Accessible by a limited number of accredited investors, qualified purchasers, or institutional investors. |

|

Regulatory Requirements |

Extensive regulatory oversight, financial reporting, and public disclosures. |

Greater flexibility vis-à-vis less stringent regulatory reporting requirements, and disclosures can be more limited and allow for greater confidentiality. |

|

Liquidity |

Generally liquid and traded on exchanges with active trading, daily price fluctuations, and often an increased focus on short-term earnings. |

Negotiated terms between investors and investment managers. Less liquid due to years-long horizons that can allow managers to focus on longer-term view. |

|

Illiquidity Premium |

Efficient markets limit opportunities for a premium and are more exposed to price fluctuations. |

Private investment opportunities typically seek to offer risk-adjusted higher returns to compensate for fewer or no early exit opportunities. |

Private Markets as an Asset Class

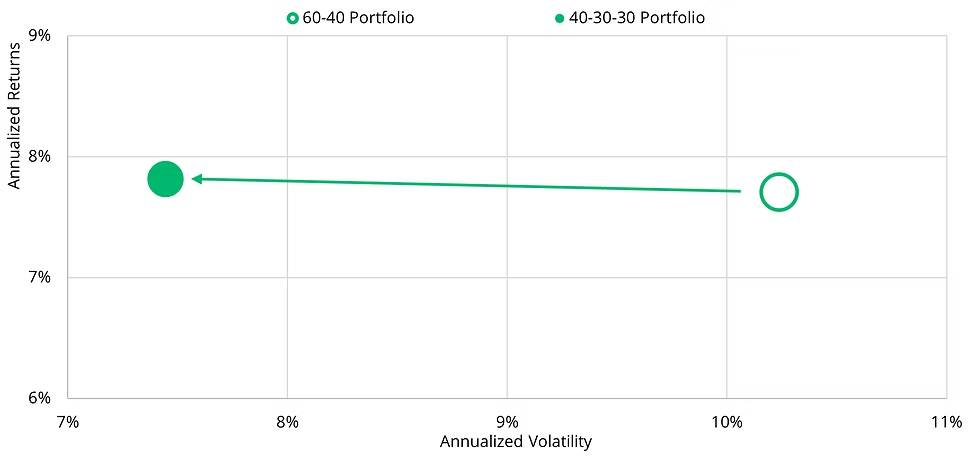

As public stocks and bonds have become more positively correlated in recent years, portfolios comprised strictly of traditional assets may no longer provide the intended diversification. Private markets can complement investment portfolios by broadening exposure while reducing the volatility of returns.

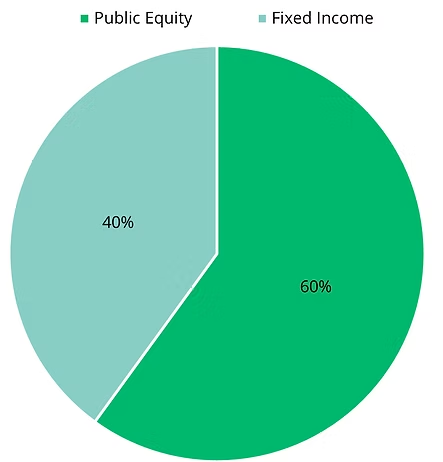

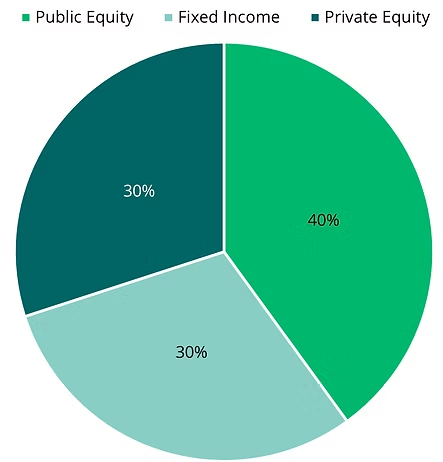

Private Equity-Infused Portfolios Can Improve Returns and Reduce Volatility: 2015-2024i

|

60-40 PORTFOLIO |

40-30-30 PORTFOLIO |

|

|---|---|---|

|

Annualized Returns |

7.7% |

7.8% |

|

Annualized Volatility |

10.2% |

7.4% |

Explore Private Markets Further

Explore select private market asset classes to understand better what they are, who uses them, and the potential to identify value.

Explore Private Real Estate Asset Classes

Explore select private market asset classes to understand better what they are, who uses them, and the potential to identify value.

The information herein is provided for educational purposes only and should not be construed as financial or investment advice, nor should any information in this document be relied on when making an investment decision. Opinions and views expressed reflect the current opinions and views of the author(s) and Bridge Analysts as of the date hereof and are subject to change at any time without notice. Please see the end of this document for important disclosure information.

Important Disclosure Information

This material is for educational purposes only and should not be treated as research. This material may not be distributed, transmitted or otherwise communicated to others, in whole or in part, without the express written consent of Bridge Investment Group Holdings LLC (together with its affiliates, “Bridge”).

The views and opinions expressed in this material are the views and opinions of the author(s) of the material. They do not necessarily reflect the views and opinions of Bridge and are subject to change at any time without notice. Further, Bridge and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views expressed in this material. There can be no assurance that an investment strategy will be successful. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially and should not be relied upon as such. Target allocations contained herein are subject to change. There is no assurance that the target allocations will be achieved, and actual allocations may be significantly different than that shown here.

This material does not constitute an offer of any service or product of Bridge. It is not an invitation by or on behalf of Bridge to any person to buy or sell any security or to adopt any investment strategy, and shall not form the basis of, nor may it accompany nor form part of, any right or contract to buy or sell any security or to adopt any investment strategy. Nothing herein should be taken as investment advice or a recommendation to enter into any transaction.

Hyperlinks to third-party websites in this material are provided for reader convenience only. Unless otherwise noted, information included herein is presented as of the dates indicated. This material is not complete, and the information contained herein may change at any time without notice. Bridge does not have any responsibility to update the material to account for such changes. Bridge has not made any representation or warranty, expressed or implied, with respect to fairness, correctness, accuracy, reasonableness, or completeness of any of the information contained herein, and expressly disclaims any responsibility or liability, therefore. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Investors should make an independent investigation of the information contained herein, including consulting their tax, legal, accounting or other advisors about such information. Bridge does not act for you and is not responsible for providing you with the protections afforded to its clients.

Certain information contained herein may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such information. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Any reference to indices, benchmarks, or other measure of relative market performance over a specified period of time are provided for context and for your information only.

Past performance is not necessarily indicative of future results.

Additional information may be available upon request.

© 2025 Bridge Investment Group Holdings LLC. “Bridge Investment Group” and certain logos contained herein are trademarks owned by Bridge.

- Commercial Real Estate: Refers to properties used for business-related purposes that can generate rental income and offer potential upside through capital appreciation.

- Investment Manager: A firm responsible for managing investments on behalf of clients or investors, with the goal of maximizing returns while managing risk. Examples of investment managers could include CRE investment managers, private equity firms, or subsidiaries of major banks, etc.

- Public Market: A financial market where securities like stocks and bonds are bought and sold openly to the public, such as stock exchanges.

- Traditional Portfolio: Typically includes a mix of conventional investments, such as stocks, bonds, and cash.

i Bloomberg, US Agg Index, as of Q1 2025. Bloomberg, SPX Index, as of Q1 2025. Cliffwater, Direct Lending Index via Bloomberg, as of Q1 2025. NCREIF, ODCE, as of Q1 2025. Preqin, US Based Private Equity Index, as of Q4 2024.

ON THIS PAGE...