The Great Reshuffling to the Sunbelt: Not Just a Flash in the Pan

Executive Summary

Pull factors continue to steer people and employers toward the Sunbelt, and we believe momentum will persist for many markets that have experienced consistent growth trends over the past decade.

The Sunbelt still leads. From 2020–2024, Texas and Florida metros led 25–44 population gains, with annualized growth broadly consistent with the prior five years.1

What is powering it? Corporate relocations and expansions, local job creation, relative housing affordability, and lifestyle preferences—all amplified by remote and hybrid work trends.

Looking ahead: Markets with above average increases in living and housing costs are likely to moderate the pace of in‑migration. We expect growth trends to continue toward markets that balance attractive pull factors with housing choice and affordability.

The Great Reshuffling to the Sunbelt: Not Just a Flash in the Pan

Recent population growth and migration have powered meaningful changes in commercial real estate values, and the past decade has made the destination of choice clear: the Sunbelt. Net domestic migration, layered on top of natural growth, helped to shift population and pricing power toward metros across the Southeast, Texas, and the Mountain West.

Over the last five years, four factors have done much of the heavy lifting: business relocation, local job creation, housing affordability, and lifestyle preferences, each shaped by the normalization of remote and hybrid work. Together, we believe these factors accelerated trends that already were underway pre-pandemic.

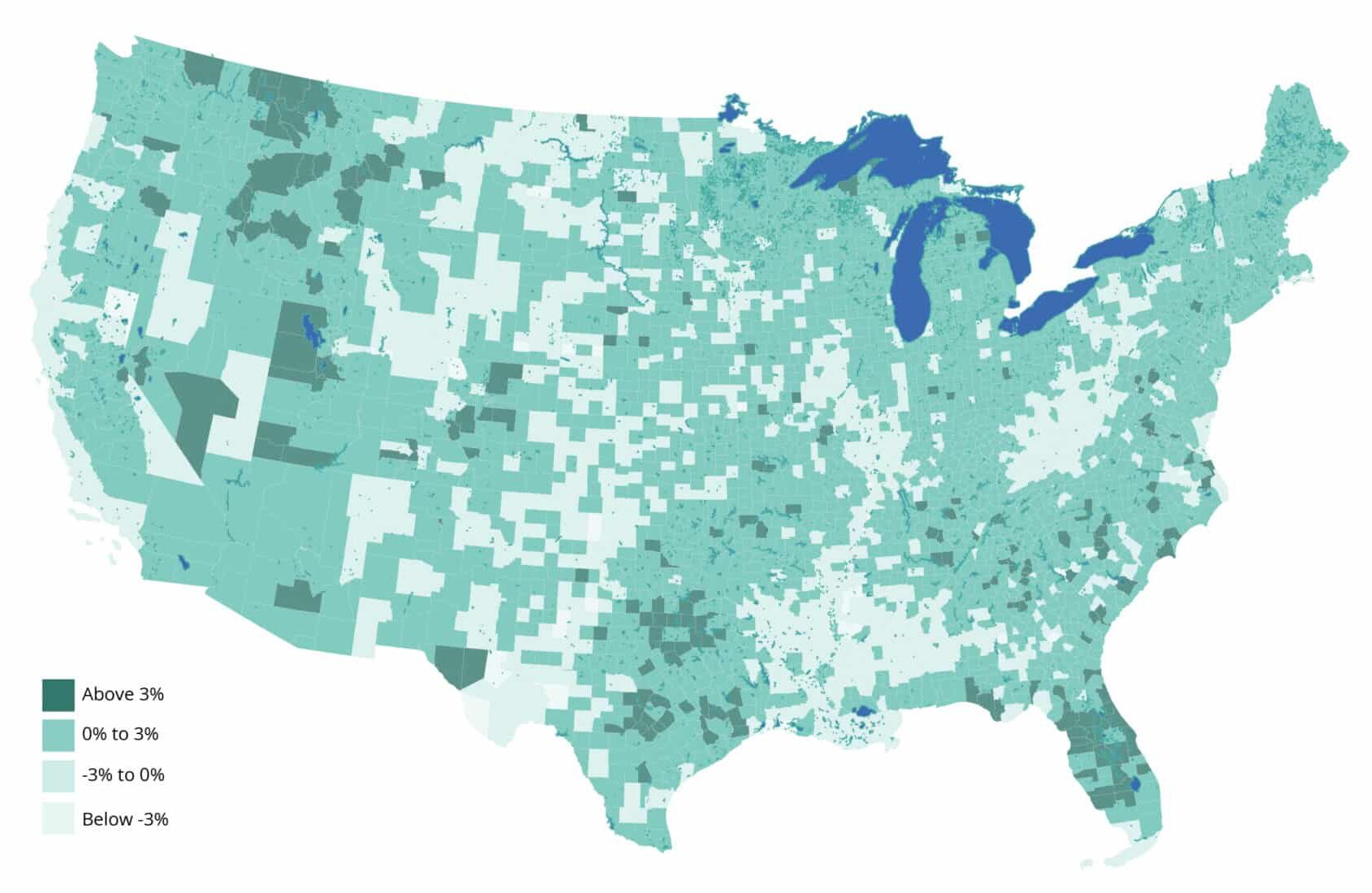

Our internal analysis indicates that from 2020–2024 the Sunbelt sustained robust growth among adults aged 25–44—the prime working and household formation cohort.1 Among the 50 largest U.S. markets, metros in Texas and Florida led this expansion, and their annualized growth rates remained broadly consistent with the prior five-year period. In simple terms, “the Great Reshuffling” looks durable, not episodic.

Why has this persisted? Over the past decade, a rising share of companies—especially in technology, finance, and manufacturing—have relocated or expanded into lower cost, business friendly Sunbelt markets. Favorable tax and regulatory regimes, expanding talent pools, and infrastructure modernization have reinforced that momentum, creating virtuous cycles of investment and employment growth.

We see signs that housing has been another decisive variable. Survey data from Development Counsellors International underscores that housing costs and supply rank among the most important lifestyle factors influencing where people move.2

Looking ahead, markets with above average increases in living and housing costs are likely to moderate the pace of in-migration. We expect growth to continue the trend toward more affordable, well-connected markets where pro housing policy, available land, and improving infrastructure can accommodate demand.

Annualized Growth in Population Aged 25-44 Between 2020-20243

1 U.S. Census Bureau, County Population by Characteristic: 2010, 2014, 2015, 2019, 2020, and 2024.

2 Development Counsellors International, Talent Wars, May 2025.

3 U.S. Census Bureau, County Population by Characteristic: 2010, 2014, 2015, 2019, 2020, and 2024.

subscribe to our market outlooks and sector insights

Disclosures

This material is for educational purposes only and should not be treated as research. This material may not be distributed, transmitted or otherwise communicated to others, in whole or in part, without the express written consent of Bridge Investment Group Holdings LLC (together with its affiliates, “Bridge”).

The views and opinions expressed in this material are the views and opinions of the author(s) of the material. They do not necessarily reflect the views and opinions of Bridge and are subject to change at any time without notice. Further, Bridge and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views expressed in this material. There can be no assurance that an investment strategy will be successful. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially and should not be relied upon as such. Target allocations contained herein are subject to change. There is no assurance that the target allocations will be achieved, and actual allocations may be significantly different than that shown here.

This material does not constitute an offer of any service or product of Bridge. It is not an invitation by or on behalf of Bridge to any person to buy or sell any security or to adopt any investment strategy, and shall not form the basis of, nor may it accompany nor form part of, any right or contract to buy or sell any security or to adopt any investment strategy. Nothing herein should be taken as investment advice or a recommendation to enter into any transaction.

Hyperlinks to third-party websites in this material are provided for reader convenience only. Unless otherwise noted, information included herein is presented as of the dates indicated. This material is not complete, and the information contained herein may change at any time without notice. Bridge does not have any responsibility to update the material to account for such changes. Bridge has not made any representation or warranty, expressed or implied, with respect to fairness, correctness, accuracy, reasonableness, or completeness of any of the information contained herein, and expressly disclaims any responsibility or liability, therefore. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Investors should make an independent investigation of the information contained herein, including consulting their tax, legal, accounting or other advisors about such information. Bridge does not act for you and is not responsible for providing you with the protections afforded to its clients.

Certain information contained herein may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such information. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Any reference to indices, benchmarks, or other measure of relative market performance over a specified period of time are provided for context and for your information only.

All rights to the trademarks and/or logos presented herein belong to their respective owners and Bridge’s use hereof does not imply an affiliation with, or endorsement by, the owners of these logos. This material may contain select images that are provided for illustrative purposes only and may not be representative of assets owned or managed by Bridge. Such images may include digital renderings or stock photos rather than actual photos of assets, residents or communities.

Past performance is not necessarily indicative of future results.

Additional information may be available upon request.

© 2025 Bridge Investment Group Holdings LLC. All Rights Reserved.

GWMS,20251104-4947464-15602636